‘Compensation Isn’t a Differentiator’

The war for talent is so intense, companies are looking for alternative ways to attract and retain employees.

Good morning!

Today’s highlights: The cost of manufacturing in China soars. Is your state taxing forgiven PPP loans? And can you build a viable sales team without quotas and commissions?

STARTUPS

Insider ranked the year’s most promising startups based on interviews with venture capitalists (who may have had a stake in the companies they suggested). Some examples:

“Calm is an app with a library of content to help its users relax and sleep, including guided meditations, audiobooks, and soothing sounds. The pandemic shone a spotlight on wellness and mental health. Calm was already one of the biggest names in wellness tech, and it's poised to expand as the world emerges from pandemic lockdowns ...”

“Cockroach Labs is the maker of CockroachDB, a popular distributed database for building cloud applications that can survive anything. Pretty simple: The world is moving to the cloud, and Cockroach made a cloud-scale SQL database,’ Seid said. ‘Simple to say, but very, very hard to do.’”

“Dandy helps dental offices combine in-person visits and virtual care. People can buy dental services such as teeth aligners online without ever seeing a dentist. But they may sacrifice quality of care. Dandy wants to marry the best of both worlds.”

“Finix's software allows companies to bring payment infrastructure in-house, rather than using services such as Square or Stripe. By bringing payments in-house, Finix helps companies reduce fees and make money from the transactions they process.”

“Instrumental is building software that automates factory assembly lines, saving billions of dollars in scrap and rework costs. ‘Founded by a former Apple lead product design manager and engineer, this company is in the right position at the right time to enable a greater shift toward complete virtual product development and manufacturing.” READ MORE

THE ECONOMY

The cost of manufacturing in China surged by the most in nearly 13 years in May: “China’s producer-price index jumped 9.0 percent from a year ago in May, accelerating from April’s 6.8 percent increase, the National Bureau of Statistics said Wednesday. The result topped the 8.6 percent increase expected by economists polled by The Wall Street Journal, and marked the fastest year-over-year rise since September 2008, when producer prices rose 9.1 percent.”

“The faster-than-expected price gains have eaten into the profitability of many small businesses downstream in China’s industrial chain that haven’t yet fully recovered from the pandemic-induced weak consumer demand.”

“However, it benefits upstream factories, whose profits more than doubled from a year earlier according to Goldman Sachs, with their products in high demand.” READ MORE

As you might have guessed, there are more job openings than ever in the U.S.: “Job openings in the United States soared by nearly a million in April, setting a record for the most openings added in a month and the highest overall number since the Bureau of Labor Statistics started tracking the data in December 2000. At 9.3 million new positions, it was far more than the 8.3 million economists polled by Refinitiv had predicted — which would have been flat from the revised March job opening numbers.”

“Although job openings surged, American employers hired just 6.1 million people in April, a slight uptick from March, leaving millions of jobs unfilled.” READ MORE

HUMAN RESOURCES

Businesses are trying everything when it comes to finding applicants and retaining employees: “College subsidies for children and spouses. Free rooms for summer hotel employees and a set of knives for aspiring culinary workers. And appetizers on the house for anyone willing to sit down for a restaurant job interview. Determined to lure new employees and retain existing ones in a suddenly hot job market, employers are turning to new incentives that go beyond traditional monetary rewards. In some cases, the offerings include the potential to reshape career paths, like college scholarships and guaranteed admission to management training programs.”

“Applebee’s is seeking to hire 10,000 people this summer and announced last month that it would hand out vouchers for a free appetizer to anyone who scheduled an interview.”

“Hoping for 10,000 applicants, the restaurant chain got 40,000 as a result of the offer, said John Cywinski, Applebee’s president.”

“[Waste Management] will pay for employees to earn bachelor’s and associate degrees, as well as certificates in areas like data analytics and business management.”

“‘We knew we had to do something radically different to make Waste Management attractive when you have other companies looking for the same type of worker,’ said Tamla Oates-Forney, chief people officer at Waste Management. ‘There is such a war for talent that compensation isn’t a differentiator.’”READ MORE

Gene Marks says two types of health insurance plans can save small employers money but are not widely known: “As of 2020, an employer with an IHRA can contribute tax free money (contributions are not subject to payroll tax and often may not be subject to income tax) to full-time and certain part-time employees’ accounts. Those workers can then use the money to help pay for qualified healthcare expenses, including premiums. Companies of any size are eligible. To offer an IHRA, you would normally have a group health insurance plan in place and there are no contribution limits.”

“But what if you can’t afford a group health insurance plan? That’s where a QSEHRA would be an option. To qualify for a QSEHRA — which has been around since 2016 — you must have fewer than 50 employees.”

“Like an IHRA, a QSEHRA lets the employer reimburse the employee’s qualifying medical expenses, including premiums. But unlike the IHRAs, there is a limit to these contributions.”

“When set up correctly, these plans may relieve an employer from having to go through the annual angst of comparing and selecting group health insurance plans as well as the headaches involved with re-enrollment and premium increases.” READ MORE

TAXES

In some states, a forgiven PPP loan represents taxable income: “While the Internal Revenue Service won’t tax forgiven PPP loans, Vermont became one of 11 states—including California, Florida, Hawaii, Minnesota, Nevada, New Hampshire, North Carolina, Texas, Utah, and Washington—that chose to tax PPP loans or have been considering it. At least 10 other states reversed course earlier this year and decided not to impose taxes, according to the Tax Foundation, a nonprofit policy think-tank.”

“Many businesses have delayed ponying up in the hopes the situation may change. But even with reopenings underway, some hard-hit businesses face stark challenges if made to pay.”

“Companies that took massive losses during the worst of the pandemic would usually be able to carry those forward, so as to lower future tax bills as they recover from a catastrophic year. But if they are forced to include PPP loans as taxable income or are unable to deduct expenses paid with those funds, those losses will look artificially smaller.

“‘This is emergency crisis aid,’ said Sarah Crozier, communications director at Main Street Alliance, which represents small businesses. ‘The money doesn’t exist anymore.’” READ MORE

SALES

Can you build an effective sales team without quotas and commissions? “Every year, Ramon Elzinga fields a handful of calls from early stage startup leaders hoping to pick his brain. They want to know how he did the impossible in sales: build a team without individual quotas. But to Elzinga, nothing could be more straightforward. When he joined Culture Amp eight years ago as its global VP of sales, he and the company’s co-founders questioned the age-old belief that money is the main thing that motivates salespeople. They bet that sales reps were a lot like other employees — driven by career growth and learning.”

“The business thrived to the point that the company is now a $1.02 billion unicorn.”

“An informal HubSpot poll in 2017 reported that just seven percent of responding sales reps, managers and leaders were in favor of eliminating quotas.”

“Reps who want to transition into management roles often have to take time away from selling to mentor their colleagues — or take on additional responsibilities on their own time, Ferrer said.”

“Chasing quota can lead to burnout if the rep doesn’t have a clear internal motivation, and it minimizes activities that don’t lead to a sale.” READ MORE

THE 21 HATS PODCAST

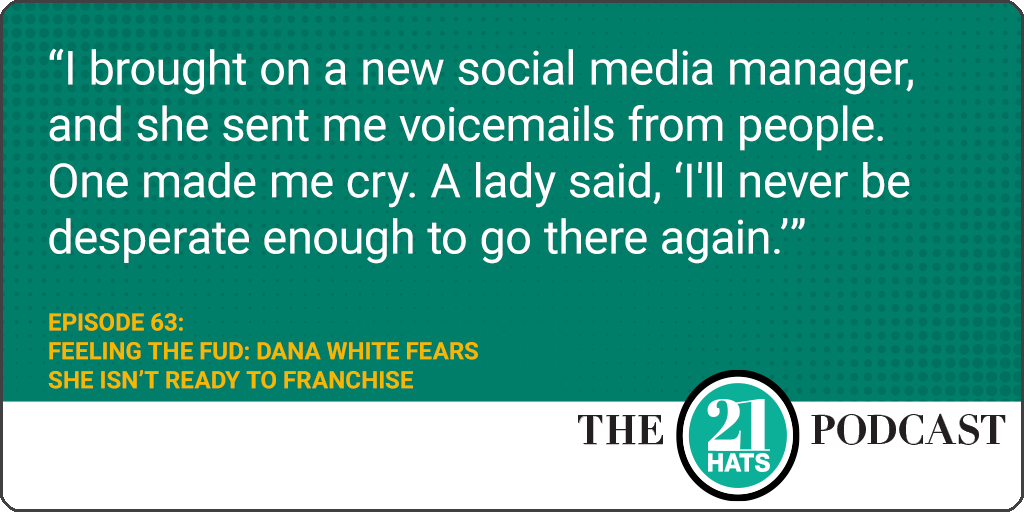

Episode 63: Dana White Fears She May Not Be Ready to Franchise: This week, Dana tells Paul Downs and Jay Goltz why she’s experiencing FUD—fear, uncertainty, and doubt—over whether she’s really ready to sell franchises in Paralee Boyd. She’s concerned because her hair salon is having some customer service issues. On the other hand, her head of operations is telling her, “If you wait to expand your business until every customer is happy and until everything is perfect, you will stay at one location for the next 50 years.” Plus, Paul resolves his cybercrime, and we find out whether Paul, Jay, and Dana have done anything to prepare for a ransomware attack. It turns out one of them has.

You can subscribe to The 21 Hats Podcast wherever you get podcasts.

If you see a story that business owners should know about, hit reply and send me the link. If you got something out of this email, you can click the heart symbol, you can click the comment icon below, and you can share it with a friend. Thanks for reading, everyone. — Loren