Customers Are Out for Revenge

More people are reporting problems with products and services, and they are looking for ways to get even.

Good Morning!

Here are today’s highlights:

Customers also feel coerced by touchscreens and payment apps with preset gratuity amounts.

Those ads promising big employee-retention tax credits are likely to be scams.

Businesses added more jobs than expected in February.

The co-founder of the Italian beef shop that inspired “The Bear” has died.

CUSTOMER SERVICE

Customers say they are encountering more problems than ever with products and services: “Some 74 percent of the 1,000 consumers surveyed said they had experienced a product or service problem in the past year. That is up from 66 percent in 2020, when the study last was conducted, and 56 percent in 2017. Only 32 percent told researchers they had experienced a problem in 1976, when a similar version of the study was first conducted.”

“The percentage of consumers who have taken action to settle a score against a company through measures such as pestering or public shaming in person or online, has tripled to 9 percent from 3 percent in 2020, according to the study.”

“‘It’s the idea of, if you as a company don’t really seem to care, well then I’m going to take to the streets,’ said Scott Broetzmann, president and chief executive of Customer Care Measurement & Consulting, which conducts the so-called National Customer Rage Survey with the W.P. Carey School of Business at Arizona State University.”

“The research, which builds on a study first conducted by the White House in 1976, albeit under a different name, found that 32 percent of complainants posted about their most serious problem on social media—more than double the proportion who did so in the 2020 study.”

“‘It’s costing companies a lot of money in future business, but there’s also the cost of servicing really angry customers,’ Mr. Broetzmann said. ‘If you think about the average number of contacts that really angry customers are making, each time they contact a business, that costs the business money.’” READ MORE

Payment apps and touchscreens that let merchants suggest preset gratuity amounts risk a backlash: “Since payment apps and touch screens make it simple for merchants to preset gratuity amounts, many businesses that didn’t ordinarily ask for tips now do. And many consumers feel pressured to oblige or don’t notice the charges. This phenomenon — known as ‘guilt tipping’ — was compounded in recent years when more privileged professionals shelled out extra to help essential workers weather the pandemic. But even as businesses have somewhat returned to normal, the gratuity requests have remained steadfast.”

“Square has said its products have led to big increases in tips for many businesses. Its technology has since been widely copied by many brands, and traditional cash registers are a rare sighting.”

“A key driver of the success of digital payment systems, design experts said, is that they take advantage of a design principle that influences consumer behavior: The default is the path of least resistance.”

“Payment technologies allow merchants to show a set of default tipping amounts — for example, buttons for 15 percent, 20 percent, and 30 percent, along with the ‘no tip’ or ‘custom tip’ button. That setup makes it simplest for us to choose a generous tip, rather than a smaller one or no tip at all.”

“‘If your users are not happy, it’s going to come back and bite you,’ said Tony Hu, a director at the Massachusetts Institute of Technology who teaches courses on product design.” READ MORE

TAXES

The IRS has issued another warning about employee-retention tax credit scammers: “The ERC is a potentially lucrative Covid-19 tax credit that could net small-business owners up to $26,000 per employee — a significant total at a time when businesses are grappling with inflation and economic concerns. But, as one of the last remaining options for Covid-19 relief, the program has become a target for scammers attempting to prey on small businesses. The IRS initially released a notice about the ERC in 2022, warning small-business owners against potential scams. But the new notice, issued March 7, stresses how aggressive these types of ERC scams have become and how they could leave small-business owners holding the bag.”

“The IRS said one potential red flag for businesses is third-parties who are advertising aggressively on the radio or online while charging large upfront fees or fees contingent on the amount of the credit.”

“The IRS cautioned those third-parties may not inform small-business owners that wage deductions claimed on their federal income tax return are reduced by the amount of the credit.”

“Experts say there are some quick and easy best practices to follow to help protect your small business from entities that might not be able to deliver the tax credit in a responsible way. That includes asking to make sure you get the ERC justification in writing, that they have the appropriate insurance if something goes wrong and that they have a history of working with businesses on tax credits.” READ MORE

THE ECONOMY

Businesses—but not smaller businesses—added more jobs than expected in February: “Private payrolls rose 242,000 last month after an upwardly revised 119,000 increase in January, according to figures out Wednesday from ADP Research Institute in collaboration with Stanford Digital Economy Lab. The median estimate in a Bloomberg survey of economists called for a 200,000 advance. The gain was led by hiring in leisure and hospitality as well as financial activities. Businesses with more than 50 employees also contributed strongly, while small firms shed jobs for a fifth-straight month. The Midwest was the only region to post a drop in payrolls.”

“Workers who stayed in their jobs experienced a 7.2 percent pay increase in February from a year ago, the slowest in 12 months, the ADP data showed. For those who changed jobs, the median increase in annual pay ticked down to 14.3 percent.”

“‘We’re seeing robust hiring, which is good for the economy and workers, but pay growth is still quite elevated,’ Nela Richardson, chief economist at ADP, said in a statement. ‘The modest slowdown in pay increases, on its own, is unlikely to drive down inflation rapidly in the near-term.’” READ MORE

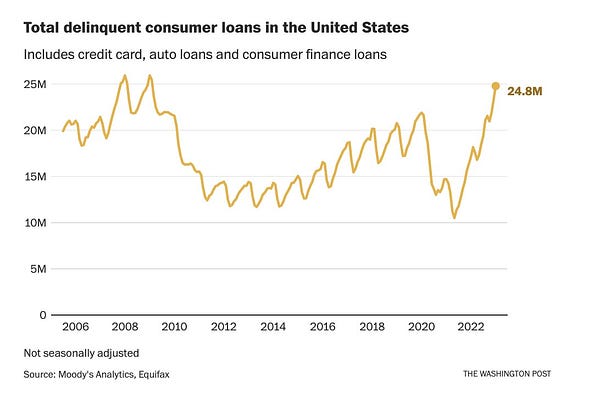

The economy is still running hot, but this may be a warning sign:

HUMAN RESOURCES

Companies are finding that on-site child care brings employees back to the office: “Though relatively small in number, more employers are acting on that sentiment and providing child care, according to the Best Place for Working Parents, a network of 1,700 businesses promoting family-friendly employer policies. Nearly 11 percent of the network’s members provided on-site child care between April 2021 and September 2022, either on their own or run by outside providers. That share is up from 9.3 percent in the first year of the pandemic, and 5.5 percent in the months before pandemic lockdowns began in March 2020.”

“The child-care offering fosters employee loyalty, as well as office attendance, says [Sheryl Shushan, director of global family services at outdoor apparel company Patagonia]. Though employees on the Ventura campus are expected to come in three days a week, parents participating in the program tend to come in all five, says Ms. Shushan.”

“She adds that on-site child care also promotes more serendipitous interactions and deeper relationships among co-workers who meet while dropping off or picking up their children.”

“Stephen Kramer, chief executive of Bright Horizons, which partners with companies to provide on-site child care at facilities it helps design and run, says that in recent months he has also heard from more corporate clients drawn to on-site daycare as a way to help motivate workers to return to workplaces. Parents using them ‘tend to be the earliest adopters of coming back to the office,’ he says. READ MORE

Tech companies, meanwhile, are ditching many of the perks they used to brag about: “Before Facebook parent Meta Platforms laid off 11,000 workers, it ended free laundry and dry cleaning services for employees. Twilio, which has had two rounds of job cuts in five months, slashed its employee allowances for spending on wellness and books. Salesforce, which is cutting 10 percent of global staff, is also dialing back a bevy of coveted benefits. Specialty-coffee baristas at the company’s San Francisco tower were shown the door. The company cut ties with Trailblazer Ranch, a 75-acre wellness retreat that mixed skills training with yoga and hiking. Also gone: the extra paid day off every month Salesforce gave employees for well-being.”

“Tech companies have long been renowned as employee-first meccas that could easily afford amenities like free meals, fitness classes, and game rooms decked out with Ping Pong tables and other diversions. Recent trims to tech’s workplace embellishments come as more companies acknowledge they grew too quickly during the pandemic.”

“The moves also signal a power shift in the boss-worker dynamic, says Dan Cable, professor of organizational behavior at London Business School. Employees quickly acclimate to all the extra benefits on offer to make them feel good about their jobs, so they’re mainly noticed only when they disappear, he added.” READ MORE

POLICY

Amid a firestorm, the FTC is giving business owners and professionals more time to comment on its proposed non-compete ban: “The FTC initially proposed the rule in early January and set March 20 as the deadline for submitting public comments. Now, the agency has extended that deadline until April 19. The FTC has been in the middle of a firestorm of comments since it unveiled the broad non-compete ban. The agency has received more than 16,000 comments so far, as well as a promise of litigation from the U.S. Chamber of Commerce, which has vowed to fight the rule in court.”

“The FTC rule would ban noncompetes, as well as overly restrictive non-solicitation agreements and training cost repayment plans. The FTC estimates the rule would affect about 30 million workers.”

“It argued the noncompetes interfere with workers' abilities to choose better jobs, and the agency estimated it would increase worker earnings between $250 billion and $296 billion a year.”

“Business owners should take advantage of the extended deadline to file their own public comment, said Leigh Ann Buziak, a partner and labor and employment lawyer at Blank Rome.”

“‘Because it is an administrative proceeding, this is your opportunity to be heard,’ Buziak said. ‘If you have something to say about this, you have to make a public comment.’” READ MORE

OBITUARY

Joseph Zucchero, co-founder of Chicago’s Mr. Beef: “Joseph Zucchero, a co-founder of the popular sandwich shop that inspired the acclaimed FX restaurant drama ‘The Bear,’ and where much of the series was filmed, died March 1 at a hospital in Chicago. He was 69. His death was confirmed by his son, Christopher Zucchero, an owner of Mr. Beef, the family’s restaurant in Chicago’s River North neighborhood, who said a cause was not known. The restaurant specializes in the Italian beef sandwich, a Chicago classic made with thin-sliced roast beef and giardiniera or roasted peppers. All of that is typically piled on a sandwich roll, and it is either drizzled with or dipped in beef juice.”

“To create ‘The Bear,’ a series about a young chef who leaves a career in New York’s high-end restaurant scene to run his family’s sandwich shop, FX shot inside and outside Mr. Beef, fictionalized as the Original Beef of Chicagoland in the show. It also created a replica of the restaurant’s kitchen in a Chicago studio, Mr. Zucchero’s son said.”

“The series, which premiered on Hulu last summer, drew acclaim from food writers and restaurateurs. And in a fine example of life imitating art that imitated life, its success led to a nationwide surge in demand for the Italian beef sandwich, including at Mr. Beef itself.”

“Mr. Zucchero was a movie fan, his son said, and his restaurant had admirers in Hollywood. Actor Joe Mantegna and comedian Jay Leno ‘would come in all the time,’ Christopher Zucchero said. He said that he has been friends with Christopher Storer, who created ‘The Bear,’ since the two were in kindergarten and that they spent time at Mr. Beef as children.” READ MORE

THE 21 HATS PODCAST: MARKETING WORKSHOP

Turning a Failing Nut Shop into Nuts.com: This week, Shawn Busse and Loren Feldman talk to Jeff Braverman about why he walked away from a career as an investment banker and went to work in the family’s nut store, the Newark Nut Co. “My dad and my uncle told me I was nuts,” says Jeff. But with an instinct for taking calculated risks—like acquiring the URL Nuts.com—Braverman has turned the family business into a direct-to-consumer juggernaut, unleashing years of explosive growth. And despite being a former investment banker, he’s managed to do that without taking any outside capital. And he’s far from finished. “To this day,” he says, “we're doing deep brand research: What is Nuts.com? What can it be? Can it scale? Can it transcend just the word nuts?”

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

Thanks for reading, everyone. — Loren