Do You Need a Chief of Staff?

Michael Girdley says every business owner should have one. Since hiring his, Girdley says, he’s doubled his productivity, and he’s having a lot more fun.

Good Morning!

Here are today’s highlights:

An iconic family-owned shoe retailer closes in Atlanta.

The craft-brewing industry keeps getting tougher.

Prices have fallen so low that even San Francisco’s office market is showing signs of life.

John Arensmeyer, founder and CEO of Small Business Majority, analyzes the policy issues owners should be watching.

OPPORTUNITIES

This Michigan couple sold everything they owned to buy a business: “In 2016, Mark Lemoine came home from work and told his wife Karla Lemoine he wanted to quit his job and buy a campground. There was a lot on the line: Mark made $200,000 per year working for the Michigan state government, and Karla was a stay-at-home mom. Two of their four children were in college. Both were lifelong campers, but they’d never owned a business. Swayed by the promise of adventure, Karla agreed. Within six months, they found a franchised Kampgrounds of America site for sale in Benton Harbor, Michigan, a rural lake town nestled between Grand Rapids and Chicago. The Lemoines put their house on the market, withdrew all their savings and ‘sold everything we owned to buy the campground’ for $1.6 million, Mark says.”

“Since buying the campground, they’ve spent another $1.5 million on renovations, and annual upkeep costs up to $700,000 a year, according to documents reviewed by CNBC Make It.”

“All those investments are paying off. The campground is now worth $6 million, a recent Kampgrounds of America valuation found. It brought in $1.2 million in revenue last year, enough for the Lemoines to pay themselves a combined $150,000 in salary.”

“They’re still $50,000 shy of their previous annual household income, but say they plan to keep running the campground for a simple reason: They’re happier.” READ MORE

MANAGEMENT

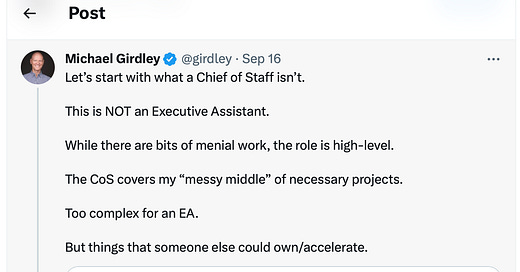

Michael Girdley thinks you should hire a chief of staff:

RETAIL

Still family-owned, a renowned shoe retailer closes after 114 years: “Bennie’s first opened in 1909 as a shoe repair shop by Bennie Shemaira, who immigrated to the U.S. from a Greek island when he was 16 years old. His original shop was located on Marietta Street across from where State Farm Arena is today. The store has since moved a few times before finally settling on its current location at 2625 Piedmont Road N.E., in the Buckhead neighborhood of Atlanta. According to the retailer, the repair shop began to sell shoes in 1970 when Johnston & Murphy rejected 365 pairs of dress shoes at its factory and sent them to Bennie’s to move the inventory. Shoe sales quickly took off from there, leading Bennie’s to become one of the top men’s shoe stores in the South by 1995 — carrying over 40 brands at its peak.”

“‘It’s over for us,’ Mark Shemaria told FN when reached by phone on Sept. 14. ‘Everybody who had stores like mine has gone under. We outlasted several independent shoe stores, but I’m just the latest in the story.’”

“Shemaria told FN that his business was hit hard by the pandemic, with business down 85 percent since 2020. This led to a battle with his landlord to keep his lease as sales plummeted. ‘I’ve lost my lease, so this is it,’ the owner said. ‘Enough is enough.’”

“‘Men don’t buy shoes in stores like they used to. All of the shoe manufacturers have their own websites now and can afford to sell the product for cheaper than I can buy them for my stores. I can’t compete with that.’” READ MORE

CLOSING THE BUSINESS

Some craft beer pioneers are closing: “Jason Santamaria quit his corporate job to chase a dream. He worked in software sales at IBM, but in the late aughts, craft beer was taking off, exciting a generation of young drinkers who wanted to imbibe something more interesting than a watery macro brew. Beer nerds held small-batch IPAs, stouts and hefeweizens in the same regard that a hipster might revere an underground indie band. Bell’s Two Hearted had the same cultural cachet as TV On The Radio. Santamaria wanted in. In 2010, Santamaria and his old friend from Georgia Tech, Chris Doyle, decided to make a career in beer. They began researching and planning their own brewery. It took more time and effort than expected, but in 2014, they opened Second Self Beer Co. in a bare-bones warehouse off Chattahoochee Avenue. But less than a decade later, Second Self brewed its last beer.”

“Second Self is emblematic of metro Atlanta’s craft brewing industry. Ongoing economic fallout from the pandemic, changing consumer tastes and increased competition is putting pressure on small breweries that have become local favorites in the past decade.”

“Second Self's sales never bounced back to pre-pandemic levels, and the company shifted its focus to contract brewing — producing beers for companies without their own facilities. Eighty percent of Second Self's revenue was coming from contract brewing, Santamaria said.”

“Santamaria said Second Self was the 42nd craft brewery to open in the state of Georgia. Now, there are more than 170, according to the Brewers Association, a national trade group.”

“Now, Santamaria is back in his old corporate job, selling software for IBM. ‘I don’t have any plans to do this again,” he said during one of his last days in the Second Self space. ‘There’s just no money in it.’” READ MORE

THE 21 HATS PODCAST: DASHBOARD

The Big Issues Looming for Small Businesses: John Arensmeyer explains what the end of pandemic-era childcare support will mean for businesses. He also talks about the Department of Labor’s proposed overtime rule and what’s at stake for business owners if the government shuts down. Plus: owners say banks are getting harder to deal with.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

ENTREPRENEURSHIP

American continue to start businesses at record rates: “Nearly 1 in 5 adults — 19 percent — are in the process of founding a business or have done so in the past 3½ years, according to the Global Entrepreneurship Monitor, an annual report by Babson College released Thursday. That is the highest level since the survey began in 1999.”

“The recent surge builds on momentum that began early in the pandemic, when sudden job losses spurred many to branch out on their own. Applications for new businesses spiked to an all-time high in July 2020, when more than 550,000 Americans filed paperwork to start their own companies, census data shows.”

“Adults between the ages of 18 and 34 were nearly twice as likely to start businesses as those between 35 and 64, the report found. And although men are still slightly more likely than women to start their own companies, that gap continues to narrow. There was also a clear shift away from service industries, such as finance and real estate, toward manufacturing and logistics.”

“But experts say many small businesses founded in recent years may be reaching a critical turning point. Economic uncertainty, higher costs and a slowdown in consumer spending have created new challenges for nascent companies. Business closures ticked up last year, to 5.2 percent from 2.9 percent in 2019, researchers found.” READ MORE

COMMERCIAL REAL ESTATE

San Francisco’s office market is showing signs of life: “Company searches for office space in the city are the highest they have been in years. Firms in the growing artificial-intelligence industry are leasing large blocks of space, signaling that the city’s appeal as a tech hub hasn’t evaporated. After a long stretch when the city’s office buildings couldn’t attract buyers even at cut-rate prices, sales are slowly materializing. Investors have purchased or agreed to purchase five major office towers in recent months, already making 2023 the most active year for sales since 2019.”

“Office transactions are resuming largely because some sellers are at last surrendering, accepting prices that would have been laughable four years ago. A local investment group, for example, purchased 350 California Street for $61 million, or about a fifth of what the building was valued at before the pandemic. Other recent sales have gone for half or less of the office property’s pre-pandemic value.”

“The new valuations are helping reset office rents, now that tenants and brokers know how far the new owners can cut rents and still make a profit. A venture of Swig Co. and SKS Partners, which acquired 350 California Street, have set asking rents in the range of $50 to $70 a square foot. Before the pandemic, asking rents for comparable space were around $90 a square foot, said Connor Kidd, Swig’s chief executive.”

“Each of the recent fire-sale deals attracted more than 10 bidders, according to Kyle Kovac, executive vice president at the commercial real-estate services firm CBRE, who brokered the 350 California Street deal. ‘There’s a lot of money that’s out there that is now ready to jump into San Francisco,’ he said.” READ MORE

THE ECONOMY

Restarting student-loan payments will pull $100 billion out of consumer pockets: “Starting Oct. 1, tens of millions of student-loan borrowers will need to make payments averaging between $200 and $300 each month. The payments will mark the first time that borrowers have had to make good on their loans since the Education Department instituted a pause in March 2020. In the interim, they spent the money on televisions, travel, new homes and thousands of other products. That spending is one reason the economy has remained resilient in recent years, despite a surge in interest rates.”

“What the resumption of loan payments means for the broader economy, however, is up for debate, and at least two groups watching closely disagree. Target, Walmart, and other retailers that depend on discretionary spending are concerned. Economists, on the other hand, say the renewed payments are a relatively small problem for the more than $18 trillion in annual U.S. consumer spending.”

“Americans have accelerated their purchases of big-ticket items such as cars in recent months, and have continued to spend more at stores and restaurants. Consumer spending, which constitutes around 70 percent of the U.S. economy, rose 0.8 percent in July, the Commerce Department said, an acceleration from the prior month.” READ MORE

OBITUARY

Jules Melancon changed oyster farming: “In his prime, the ursine Mr. Melancon would lug two 120-pound sacks of oysters onto a truck. But it was lucrative, too: He’d sell 400 of those bags in a day, at up to $15 a bag, to canneries and wholesalers that shipped worldwide. The good days didn’t last. By the end of the 1990s, rising sea levels, pollution, and erosion were driving down the oyster population and making the fragile region vulnerable to storm damage. ‘We started feeling it before Katrina, that the oysters were on the downhill,’ Mr. Melancon told The Morning News, an online magazine, in 2015. ‘And then after Katrina, it kind of phased out the oysters, about two-thirds of them, and then in 2008 the oysters started coming back strong, and then we had the BP spill.’”

“Mr. Melancon was on the brink of quitting when a friend, Jim Gossen, who owned one of the Gulf Coast’s biggest seafood wholesalers, told him about a new type of oyster farming being tested by Auburn University researchers near Mobile, Ala. Instead of dredging, farmers grew spats, or immature oysters, from pinhead-size seeds in drums on land. When the oysters were the size of a quarter, they went into chicken-wire cages suspended in shallow water.”

“Wild oysters might take five years to reach full size; with this new approach, exposing them to a rich flow of nutrients, they needed less than 10 months. And they were perfect: big and meaty, with photogenic shells that looked perfect on a raw bar.”

“Mr. Melancon did well financially, but only relatively. Despite the growing renown of his oysters — he shipped to restaurants as far away as Seattle — he was sometimes just scraping by, making a fraction of what he had made in the past. Hurricane Ida, in 2021, set him back, as did a serious back injury he sustained while trying to fix his storm-damaged roof.”

“‘When you meet somebody that tries to be the best at what they do, I don’t care if he’s a ditch digger,’ Mr. Gossen said by phone. ‘There’s a certain aura about them when they want to be the best.’” READ MORE

THE 21 HATS PODCAST

The temptation of private equity: This week, Shawn Busse, Jennifer Kerhin, and William Vanderbloemen discuss private equity. Both William and Jennifer have been getting emails and calls from representatives of PE firms who come promising all kinds of gifts—connections, expertise, money to invest in the business, and money to take off the table—which is why the temptation can be great. “If anybody even just offered me a three-day vacation, I think I would jump at it,” Jennifer jokes. But of course PE firms do exact a price, possibly including control of what used to be your business, which is why Jennifer says she wonders whether she should even take the phone calls. Entering the conversation, she says, feels a little like entering the Garden of Eden. Do you take a bite of that apple?”

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

Thanks for reading, everyone. — Loren