Every Business Tells a Story

Janie Deegan, owner of a growing Manhattan bakery chain, says her biggest accomplishment is being sober.

Good Morning!

Here are today’s highlights:

A renowned farm-to-table restaurant decides it’s time to try a very different business model.

If you’re using Salesforce CRM, Gene Marks says, you’re paying too much.

Wait! She can’t be a fraud. She was on the Forbes 30 Under 30 list!

There’s no recession in the pet industry.

PROFILE

Janie’s Life-Changing Baked Goods has an open-door hiring policy for people recently out of prison or a shelter: “Janie Deegan said she was 25 and homeless when she got sober. Soon after, she discovered baking. ‘I was stuck in an overwhelming darkness with no hope or glimpse of the future,’ said Ms. Deegan, now 35, who is the founder of Janie’s Life-Changing Baked Goods, which she started out of her home almost eight years ago. ‘Baking became this controlled artistic, meditative act of self-care,’ she said. In 2021, she opened her first shop on Manhattan’s Upper West Side. Last fall, she opened a second location in East Harlem. For both stores, she has ‘an open-door hiring policy for people recently out of prison or a shelter who want to work,’ she said. Janie’s, which specializes in pie crust cookies, or mini pies with fruit fillings, produces about 1,500 cookies per day. Ms. Deegan lives on the Upper West Side with her boyfriend Josh Raff, 37, who co-owns Five4Five Films, which teaches media skills to high school students.”

“Sunday is the one day I don’t set an alarm. I know people are at the bakery at 7 a.m., so from 7 to 9, I check my phone to make sure there aren’t any issues while trying to fall back to sleep.”

“For the past five years, I’ve been training for the New York City Marathon. I’ve done two so far. If I’m not training, I’ll run four to six miles.”

“Maintenance is life for me. I wish I could put being sober on a résumé because it’s my biggest achievement, so I’m always connecting with others in the program.” READ MORE

BUSINESS MODELS

Vivian Howard, who recently closed Chef & the Farmer, a renowned farm-to-table restaurant in North Carolina, has plans to reopen with better margins: “It will suit both the guests and the people who feed them. We won’t rely on the diners to pay servers; the chefs will serve, cafeteria-style, at our retrofitted kitchen bar. The energy we put into elevated service and its trappings will flow directly into the only ‘program’ we have chosen to keep — our food. Most important, we will open to diners just four days a week, from 11 a.m. to 9 p.m., because that’s the kind of schedule that nurtures staff retention. But our kitchen will make money seven days a week, because we’ll be cooking for people whose butts are not in our dining room.”

“Chefs who have graduated from nights on the line to quiet days in the kitchen will cook meals to stock the restaurant’s small collection of free-standing, strategically located smart fridges.”

“Covid gave us many horrible things, but it also birthed a new and relatively inexpensive way to enjoy food tapped by a chef’s magic wand at home. Next-level take-and-bakes, chef-prepared assemble-and-eats, and pasta deliveries, when coupled with an already operating kitchen, will help make us whole.”

“It may sound far-fetched and parts of it may not work, but our industry needs to do more with less.” READ MORE

THE 21 HATS PODCAST: DASHBOARD

Gene Marks on ChatGPT, Salesforce CRM, and the Contractor Dilemma: This week, Gene discusses the “inconvenient truth” about Salesforce CRM, which is that it’s probably not right for most small businesses. Already using it? Gene explains how to assess whether it’s worth the pain of switching. Plus: Gene thinks the Department of Labor’s new worker-classification law will be a disaster for smaller businesses—but suggests some ways it could be improved. Gene also has some thoughts about ChatGPT’s value to businesses: real potential, not there yet.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

LITIGATION

This story about an allegedly fraudulent founder is also an indictment of the media: “When JPMorgan Chase paid $175 million to acquire a college financial planning company called Frank in September 2021, it heralded the ‘unique opportunity for deeper engagement’ with the five million students Frank worked with at more than 6,000 American institutions of higher education. Then last month, the biggest bank in the country did something extraordinary: It said it had been conned. In a lawsuit, JPMorgan claimed that Frank’s young founder, Charlie Javice, had engaged in an elaborate scheme to stuff that list of five million customers with fakery. ‘To cash in, Javice decided to lie,’ the suit said. ‘Including lying about Frank’s success, Frank’s size, and the depth of Frank’s market penetration.’ Ms. Javice, through her lawyer, has said the bank’s claims are untrue.”

“Ms. Javice has said she needed [financial aid] help herself while she was an undergraduate at the Wharton School at the University of Pennsylvania, where she quickly drew notice by appearing on Fast Company’s 2011 list of the 100 most creative people in business.”

“All along, Ms. Javice was making frequent media appearances. In December 2017, she wrote an opinion piece for The New York Times with the headline ‘The 8 Most Confusing Things About FAFSA.’ The piece contained so many errors that it required an eight-sentence correction.”

“A Business Insider article from October 2018 that appeared on Yahoo!Finance had a headline proclaiming, ‘A 26-year-old founder has a solution to what Bill Gates calls an ‘unnecessary roadblock’ to college — and her startup is helping students get thousands off their tuition.’”

“List accolades turned up in bunches. Ms. Javice appeared on the 2019 Forbes 30 Under 30 finance list. Then she made the Crain’s New York Business 40 Under 40 list. ‘Javice has done her homework,’ the Crain’s article said.” READ MORE

THE ECONOMY

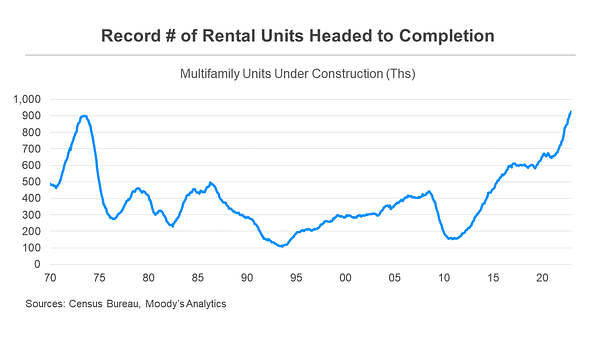

Mark Zandi’s optimism continues to build:

THE BUSINESS OF PETS

Don’t try to tell veterinarians there’s a recession coming: “To start 2020, Morgan McDaniel fulfilled a lifelong dream: She bought her own veterinary practice, a financial leap that took a $4.5 million loan. Then the pandemic hit, as did America’s pet adoption boom. Cat and dog parents kept asking McDaniel’s Montgomery Animal Hospital in Pineville, La., for more services. Could it provide long-term care for a dog’s torn ACL? Did it offer overnight boarding? McDaniel decided she could, tacking on a $750,000 loan to expand her practice by more than two dozen doggy bedrooms, an exam room for specialty procedures, and an artificial turf play field. She bought an underwater treadmill for rehab care and had a slushy beverage machine installed as a treat for her 35 employees. ‘I dream big, I’ll say that. It seems extreme in some cases,’ McDaniel said.”

“Similar stories can be found across the country as the animal health-care sector experiences stunning growth. Now veterinarians are busting down walls or breaking ground to make room for new clients clamoring for boarding, day care, and grooming.”

“Their balance sheets are getting more complicated, too. In the first nine months of 2022, small-business loans to vet offices spiked 23 percent at PNC Bank, a spokesman said. At Huntington National Bank, vet credit requests have quadrupled in the past four years.”

“McDaniel’s luxury dog-boarding service allows owners to engage with their pets through daily video calls. The clinic’s staff of veterinary technicians and assistants tucks pups into bed each night and gives them nightly treats.” READ MORE

Somebody has to walk all of those pandemic puppies: “Though searches on Rover and other job sites yield beginner dog walkers in Manhattan who charge as little as $14 for a 30-minute walk, seasoned dog walkers with well-heeled clients are charging nearly three times as much, and earning $100,000 or more a year. After all, it is a bull market for pet care providers. According to the American Society for the Prevention of Cruelty to Animals, more than 23 million American households — nearly one in five nationwide — acquired a dog or cat during the pandemic. With many Americans back in the office, somebody has to walk all those pandemic puppies.”

“[Bethany] Lane started walking dogs 11 years ago, after graduating from Rutgers University and moving to New York City to pursue a public health career. ‘I had to pay my rent and student loans, so I went on Craigslist,’ she said. ‘I saw that somebody would pay me to walk dogs. As an animal lover who is obsessed with dogs, it was perfect.’”

“As business took off, she founded Whistle & Wag in 2014 as a boutique pet care service in the West Village. At one point, she was working 12-hour days, and she was able to pay off her student loans and hire other dog walkers.”

“Now, nearly three years after the start of the pandemic, she can’t keep up with demand. After raising her rates (she quoted one customer $35 a walk), and taking on dozens of new clients, she expects she will have made six figures last year.” READ MORE

STARTUPS

A co-founder of Nest, Matt Rogers, will take your kitchen scraps for $33 a month: “Rogers and Harry Tannenbaum, another Nest alum, have quietly built their new startup since early 2020. So quietly that they’ve hired nearly 100 people in California and other spots across the country without sharing the company’s name or what they do. It’s called Mill, both the company and its two-foot tall kitchen bin that, as Rogers puts it, ‘dries, shrinks and de-stinks’ all the food heaved in. You can only get the bin by signing up for Mill on a subscription plan, starting today at $33 a month.”

“When your bin fills up, you pour the dried remains into a cardboard box—Mill ships you these—and leave that on your porch, where it’s picked up and trucked to a facility that processes your kitchen scraps into a feedstock ingredient, before shipping it to a farm where it’s fed to chickens.”

“The device blends right into the room. It looks like a trash can—one of those sleek, steel models, cream-colored with a small foot pedal at the base.”

“To work, Mill must pull off a logistics feat, coordinating with trucks, farms, city governments, and federal regulators. Hardest of all will be convincing people to change what they do in their kitchens.” READ MORE

A construction startup thinks it can print houses that are twice as good and half the price: “In 2017, [Jason] Ballard co-founded Icon, a construction startup focussed on what he believes to be a solution to the housing crisis: 3-D-printed construction, a largely automated method that creates buildings layer by layer, typically with cement-based material. The company has offices in the Yard, a mixed-use development in a formerly industrial area of Austin, Texas. The Yard is currently home to a sake company, a winery, a brewery, a canned-cocktail company, a hard-seltzer manufacturer, a whiskey distillery, and a Tesla dealership. On the morning I visited, the air was thick with the sweet-sour smell of fermentation.”

“Until last year, Icon, one of the biggest and best-funded companies in the field, had printed fewer than two dozen houses, most of them essentially test cases. But, when I met Ballard, the company had recently announced a partnership with Lennar, the second-largest home-builder in the United States, to print a hundred houses in a development outside Austin.”

“When they’re complete, the Wolf Ranch houses will range from fifteen hundred to twenty-one hundred square feet and come equipped with solar panels on their pitched metal roofs. Lennar anticipates that their prices will start in the mid-four-hundred-thousand-dollar range.”

“‘What if we could build houses that work twice as good in half the time at half the price? What kind of problems could we solve? What kind of opportunities would open up before us?’ [Ballard] asked. ‘Humans are amazing, life is a miracle, and we can do this.’’” READ MORE

THE 21 HATS PODCAST

A New Way to Sell Your Business: Michael Brown, co-founder of an innovative company called Teamshares, explains how he and his co-founders are buying the businesses of Boomer owners who are ready to retire but, in many cases, struggling to sell. Once the business is bought, Teamshares is turning the employees of those businesses into employee-owners, which is intended to strengthen the businesses while also addressing income inequality. So far, starting in 2020 and flying largely under the radar, Teamshares has bought more than 60 businesses in more than 40 industries, most ranging between $1 million and $5 million in revenue. Along the way Teamshares is learning some intriguing lessons about what it takes to build a business.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

Thanks for reading, everyone. — Loren

Loved reading the JPMorgan-Javice $175 million fraud stuff. It was summarized in a convenient package. Just a reminder of how easily we trick ourselves into believing a story that fits with a narrative that we've invested in, that fits our belief system.