‘I Pay Myself $1,000 a Week’

But many day-care owners can’t even pay themselves a living wage. One reason: there are 100,000 fewer child-care workers than there were before the pandemic.

Good morning!

Here are today’s highlights:

Should you buy back your employees unused vacation days?

These are not easy times to be a real estate agent—especially in Texas.

California pot companies are getting sued over alleged “potency inflation.”

Steven Levy says those waves of tech layoffs are sure to produce one thing: more entrepreneurs.

MANAGEMENT

These days, running a day-care center is extremely challenging: “As businesses rebound from the pandemic, one critical piece of the workforce — in fact, the part that allows the rest of it to function — is still struggling: the child-care industry. Short-staffed, underpaid, and still reeling from the losses they sustained during mandated closures, many day-care owners can’t even pay themselves a living wage. Another problem? There are 100,000 fewer child-care workers than there were before the pandemic — a loss of almost 10 percent, according to the latest data from the Bureau of Labor Statistics. The shortage has forced many day-care centers to cut enrollment numbers or even close for good. Inflation hasn’t helped, either. Here, we talked to three day-care owners about how they’re managing to make ends meet despite the challenges they face:”

“Two years ago, I could get an assistant teacher with no experience and no education for $15 or $16 an hour. Now it’s $18 or $19 an hour, and that’s not even with any qualifications. People who do have qualifications, they go for over $20 an hour — up to $25 an hour if they have experience. That was not the case two years ago. I used to post a job and I would get hundreds of applicants a day. Now I get maybe two. I’m not sure where they are going.”

“I can’t afford corporate-style benefits, but we do health insurance and scholarships if they want to advance in the field. But then it’s a very thin line between paying our teachers enough and operating a profitable business. I’m a million dollars in debt from opening the center; that’s how much I had to take out for the mortgage and the construction.”

“I pay myself $1,000 a week, or about $50,000 a year. That’s what I can afford at the moment. It’s a little bit more than what I was making when we were an in-home day care, but back then a lot of our personal expenses were covered; 75 percent of our rent was paid through the business, for example, and that’s not the case anymore. I have three kids of my own, and my husband thankfully works as well. We’re getting by.” READ MORE

HUMAN RESOURCES

Should you offer to buy back your employees’ unused vacation days? “When newly licensed social worker Javon Garcia was hired in late 2020 by Howard Brown Health, an LGBTQ nonprofit in Chicago, he was thrown into a new life as a virtual therapist. Between the pandemic-induced spike in the number of people seeking help and the absence of anywhere to go, he barely took any time off work. So when Garcia got an email telling him he could trade some unused paid time off for cash, he lit up. Howard Brown offered that deal through a partnership with a startup called PTO Exchange. Garcia needed the extra money to cover a bill. ‘Oh my gosh, this is perfect timing,” he thought. He promptly cashed out $300 worth of PTO to cover his expenses.’”

“Garcia took a deal dangled before a growing number of U.S. workers, whose PTO balances swelled during the pandemic. Startups have popped up in the past several years to help employers offer to buy out workers’ unused vacation days.”

“The pitch to employees: Get paid cash for time off you earned. To employers, PTO Exchange and its rivals argue that the programs improve retention and lighten a major financial liability for companies that pay out unused PTO when an employee leaves.”

“‘The purpose of vacation is not to give people money but to sustain them through a career or a long period of hard work,’ says Josh Bersin, an analyst who tracks HR technology.”

“To that, these founders say, the stark reality is that Americans don’t use all their time off, a phenomenon that long preceded the pandemic.” READ MORE

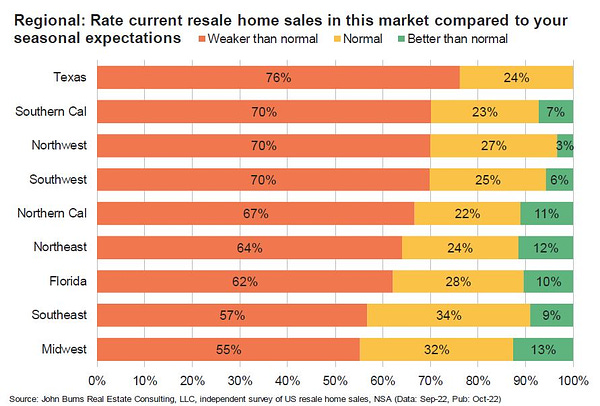

REAL ESTATE

These are not easy times to be a real estate agent—especially in Texas:

ELECTION DAY

Gene Marks says the biggest takeaway from the midterms is that the economy is stronger than we thought: “Take my client, a 150-person manufacturer located in New Jersey. 2022 was a profitable year for them. They added employees and are looking for more. They bought equipment and inventory. They raised prices and were also the recipient of price increases. They did so good this year that we had to increase their estimated tax payments so they wouldn’t be hit with a big bill come January. Sure, they’re concerned about 2023’s prospects, but that’s not uncommon coming off a good year and looking to an uncertain future.”

“And what about their employees? We read that inflation is at 8.2 percent and the prices of groceries and gas have ‘skyrocketed.’ But, according to recent data from payroll company ADP, the employees and their customers saw an average pay increase of 7.7 percent over the past year.”

“So, where’s the recession? GDP was up 2.6 percent this quarter. Household wealth, despite taking a hit thanks to market declines, remains at historically high levels, as does consumer spending.”

“Let’s acknowledge that right now the economy doesn’t seem to be so bad.” READ MORE

LITIGATION

California pot companies are getting sued for not getting their customers high enough: “In the past three weeks, Santa Monica law firm Dovel & Luner has sued four companies in two class-action lawsuits, alleging the pot sellers have been overstating how much THC is in their pre-rolled joints. Both suits cite an investigation into THC inflation by cannabis news site WeedWeek, which commissioned lab tests of pre-rolls being sold in California and found that ‘potency inflation is close to ubiquitous’ in the market. ‘I’m not surprised [this lawsuit] got filed,’ said Hilary Bricken, a Los Angeles cannabis attorney. ‘I think a lot of this behavior is rampant in the industry and it was only a matter of time before a plaintiff firm would figure it out and test the waters.’”

“California’s pot shops charge more for products with higher levels of THC, the primary intoxicant in cannabis, giving pot brands a financial incentive to overstate how much is actually in their products.”

“Pot customers pay, on average, almost twice as much for cannabis that claims to contain more than 28 percent THC, compared with cannabis labeled as containing less than 21 percent THC, according to data provided to SFGATE by cannabis software company Flowhub.” READ MORE

SILICON VALLEY

Tech CEOs are issuing apologies for thinking their pandemic boom was permanent: “The CEOs’ statements reflect, in part, the shock of the sharp downturn that worsened across the tech sector recently. They also convey the illusion of permanence that can set in during boom times—especially in an industry that was on an extended growth run before the Covid-19 pandemic—despite the longstanding conventional wisdom that, as investors are often warned, past performance isn’t a reliable indicator of future results. For some of these executives, it is also the first time they need to navigate a significant economic downturn.”

“Tech companies experienced a jump in the amount of time people spent online during the Covid-19 lockdowns that began in 2020. Industry leaders responded by hiring briskly to take advantage of the opportunity and amass talent.”

“Mr. Zuckerberg had expanded head count at his company by more than 80 percent since the start of the pandemic, to roughly 87,000 employees. Google parent Alphabet added nearly 68,000 staffers, a roughly 57 percent increase, from the start of 2020 through this September. Twitter’s staff more than doubled during the first two years of the pandemic.”

“Fast forward two years and demand for everything from digital advertising to computer chips has slumped sharply, as people resumed routines and a deteriorating economic outlook weighs on consumer spending.” READ MORE

Steven Levy writes that out of the ashes of the current layoffs will rise the next great tech startups: “When the great business cycle mandala turns and Wall Street puts away its yellow flag, the companies that let go of their talent will find themselves playing catch up. They will spend millions of dollars to restaff their ranks of recruiters, and those new scouts will spend many millions more to attract new employees. But those companies may find they have fearsome new competition. Where do you think the people who lost jobs in 2022 are going to find work? Every Big Tech company seems to be either laying people off or refraining from hiring new ones. The obvious opportunity is joining a startup.”

“If you have a great idea about how to take advantage of the ever-upward arrow of tech progress, there’s never been a better opportunity to snag talented people to help you build your dream.”

“And I imagine hundreds of newly laid-off engineers, product managers, and designers are discussing how to launch new companies based on ideas they’ve been secretly hatching for months, while they toiled for companies now feeling insecure about their ad-based business models.”

“Funding might get tougher, since investors are no longer throwing millions of dollars at any hoodie-shrouded Stanford grad with a laptop and a Github account, but the discipline required when seed rounds are more modest will help toughen those businesses for the long run.” READ MORE

THE 21 HATS PODCAST

There’s Big Money All Over the Place: This week, Shawn Busse tells Jay Goltz and Sarah Segal that he sees all kinds of opportunities for small businesses, including his own, in the coming wave of climate-related government spending and tax credits. Count Jay among the convinced. He’s got four buildings, five vans, a truck, some Sprinters and a parking lot where he could put a charging station. If there’s government money available for upgrades, he asks, “Why wouldn’t I do that?” Plus, Jay explains how he’s rethinking his search for an HR person. And Sarah tells us she’s ready to meet in the metaverse.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

Thanks for reading, everyone. — Loren