It’s a Mr. Wonderful Life!

Kevin O’Leary — Mr. Wonderful on “Shark Tank” — offers a bleak view of what it takes to be a successful entrepreneur. Is he right?

Good Morning!

Here are today’s highlights:

Who knew you could sell cookies on LinkedIn?

Companies that struggled to get fully staffed may live to regret their layoffs.

Looking for a business to buy? You might want to check the PPP data.

A mainstay of the organic food movement decides to bet the farm on weed.

MANAGEMENT

Mr. Wonderful says the price for entrepreneurship can be quite high — but it doesn’t matter. “The brouhaha started on Saturday morning when [Kevin] O'Leary tweeted: ‘You may lose your wife, you may lose your dog, your mother may hate you. None of those things matter. What matters is that you achieve success and become free. Then you can do whatever you like.’ The tweet did not go over well with Twitter users, who found O'Leary's no-holds-barred position lacking compassion and humanity.”

“O'Leary, who never met a controversy he couldn't publicize, took to the airwaves this week to defend his position. He told CNN that he stands by his tweet ‘100 percent,’ arguing that being an entrepreneur takes tremendous sacrifice.”

"’If you're an entrepreneur, you know exactly what I'm talking about because you need to sacrifice. You have to work 25 hours a day, eight days a week, because your competitors in Mumbai or Shanghai — they want to kick your butt. You have to win when you're young and sacrifice everything so that you achieve freedom for your whole family later in life,’ he said.”

“O'Leary blasted his critics as not understanding the nature of entrepreneurship. ‘If you don't get it, don't worry about it cause you don't fit the entrepreneurial mold,’ he said. ‘If you're not ready to work your ass off, you're not an entrepreneur, get over it if that makes you uncomfortable. I couldn't care less.’” READ MORE

THE 21 HATS PODCAST: MARKETING WORKSHOP

Grayson Hogard Figured Out How to Sell Cookies on LinkedIn: This week, Shawn Busse and Loren Feldman are doing something a little different. This is the first in a series of episodes we’re calling Marketing Workshops. In an attempt to confront one of the biggest pain points business owners face, we’re publishing conversations with owner-operators about their marketing experiences: what’s worked and what hasn’t. We’re starting with Grayson Hogard, co-founder of Grove Cookie Company. For Grayson and his wife, Marie, the company is a bootstrapped side hustle, but in a very short time they’ve come to some very smart conclusions about their marketing that might seem counterintuitive at first. Most importantly, they’ve figured out that the most effective sales channel for their cookies is, of all places, LinkedIn.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

OFFICE SPACE

With the return to the office still not getting traction, landlord defaults are escalating: “Five to 10 office towers each month join the list of properties at risk of defaulting because of low occupancy, expiring leases or maturing debt that would have to be refinanced at a higher rate, according to Manus Clancy, senior managing director with data firm Trepp Inc. Concerns over the health of the office building industry have mounted throughout the pandemic. The weak return-to-office rate has led to soaring vacancy levels in many cities. Last year’s spike in interest rates increased the cost of buying and refinancing properties and squeezed property values.”

“‘Commercial real-estate markets are currently in a recession,’ said Owen Thomas, chief executive of Boston Properties, one of the country’s largest office building owners, on an earnings call earlier this month.”

“The number of employees returning to the office rate has plateaued at around half the level it was before the pandemic, reflecting the popularity of remote and hybrid work policies. Cutbacks in the tech sector are adding to property owner woes.”

“Loan officers are steering away from new mortgages backed by office buildings unless they are fully leased for long periods of time by creditworthy tenants. ‘It’s like you’re taking a career risk’ by making an office loan, said Mr. Clancy of Trepp.” READ MORE

HUMAN RESOURCES

American workers are embracing the sabbatical: “Taking a sabbatical is becoming popular across industries and the workforce. In an analysis for The Post, payroll processor Gusto found that employees taking leaves of absence for more than a few weeks accelerated since covid hit. In January 2022, about 6 percent of employees started a sabbatical — nearly double the January 2019 rate. Gusto found that 25- to 34-year-olds were the most likely to take a sabbatical, followed by 35- to 44-year-olds. Women were also more likely than men to take this kind of break, which differs from parental leave.”

“Since LinkedIn launched a career break option last March allowing people to check a box to show their status, more than half a million people have used it.”

“‘I’ve regained control over what is important to me and what I should be working toward,’ said Tricia Cuna Weaver, who has been on a nine-month sabbatical after selling her stake in a digital finance company. ‘It’s time for me to be my own boss. If not now, when?’”

“As popularity grows, some employers are starting to view sabbaticals not as a detriment but as a way to fight burnout. Roughly 5 percent of companies offer paid sabbaticals and 11 percent offer unpaid options, according to the Society for Human Resource Management.” READ MORE

The big tech companies may come to regret those layoffs: “The job prospects in Big Tech are so grim that career counselors at even the most elite universities are urging students to consider positions at smaller companies and in less sought-after sectors, such as manufacturing or government. ‘There are still plenty of opportunities, and we try to get students to focus on how their skills can be used in other environments,’ says Sue Harbour, the executive director of the career center at the University of California at Berkeley.”

“Many non-tech employers, in fact, are seizing the chance to recruit the kind of talent that is usually snapped up by Big Tech. On the jobs board Handshake, government agencies are looking for 36 percent more entry-level software workers than a year earlier, and the construction sector is looking for 28 percent more.”

“Students have watched as tech companies have kicked thousands of employees to the curb — sometimes via middle-of-the night emails that left them with no chance to say goodbye to their coworkers.”

“After that, it's hard not to see Big Tech in a different light. Suddenly, in the eyes of Gen Z, tech seems to be just as ruthless and unreliable of an employer as banking did to millennials who came of age in the Great Recession.” READ MORE

OPPORTUNITIES

The federal government is spending more money with small businesses—but the money is going to fewer businesses: “The data, from a recent study by HigherGov, which offers market intelligence and development tools for government contractors, showed the total dollar amount going to small businesses has grown significantly since 2010, but the number of businesses has continued to shrink. In 2010, the number of small businesses that received government contracts hit 121,270, according to the report. By 2022, it had been cut by more than half to just 58,681.”

“In fiscal 2022, about 23.2 percent of contracting dollars went to small businesses, according to the report, down from 24.1 percent in fiscal 2021 but higher than at any point since 2010.”

“The dwindling number of small businesses in the government contracting ecosystem is a well-known problem, and one that agency leaders have stressed they are trying to solve.”

“‘We’ve seen unfortunately in the last 10 years some data points that are causing concern. We have seen the industrial base decrease 30 percent over the last 10 years, showing that less small businesses are doing business with the federal government,’ SBA Administrator Isabel Guzman said in a conference call with reporters last year.” READ MORE

BUYING A BUSINESS

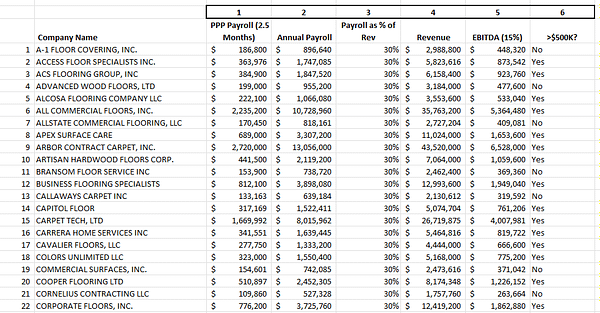

You can screen PPP data to find potential acquisitions:

FINANCE

In case you were looking for another reason to avoid venture capital: “Startup investors are increasingly warning of an apocalyptic scenario in the VC world — namely, the emergence of ‘zombie’ VC firms that are struggling to raise their next fund. Faced with a backdrop of higher interest rates and fears of an oncoming recession, VCs expect there will be hundreds of firms that gain zombie status in the next few years. ‘We expect there’s going to be an increasing number of zombie VCs; VCs that are still existing because they need to manage the investment they did from their previous fund but are incapable of raising their next fund,’ Maelle Gavet, CEO of the global entrepreneur network Techstars, told CNBC.”

“That number could be as high as up to 50 percent of VCs in the next few years, that are just not going to be able to raise their next fund,’ she added.”

“They still operate in the sense that they manage a portfolio of investments. But they cease to write founders new checks amid struggles to generate returns. Investors expect this gloomy economic backdrop to create a horde of zombie funds that, no longer producing returns, instead focus on managing their existing portfolios — while preparing to eventually wind down.”

“‘It happens during every downturn,’ Michael Jackson, a Paris-based VC who invests in both startups and venture funds, told CNBC.” READ MORE

AGRICULTURE

One of the most prominent names in organic food decides to bet the family farm on weed: “Hepworth Farms, in Milton, N.Y., is a regional power player, a name brand in everything from lettuces to leeks, and the rare grower that has managed to combine farmer’s market bona fides with serious scale. Hepworth’s produce graces C.S.A. (community-supported agriculture) boxes and is beloved by the discerning members of the Park Slope Food Coop, in Brooklyn. As grass-roots organic growers go, Hepworth is as pure as they get. But the farm also supplies supermarkets and restaurants all across the Northeast; in peak season, its owners said, Hepworth moves 15,000 cases of produce every day.”

“Grappling with the shrinking profitability of vegetable farming, and in a hole from their hemp foray, last March, the sisters applied for, and received, one of more than 200 conditional cannabis cultivator licenses that New York State handed out to farmers in 2022, a year after the sale of recreational marijuana was legalized in the state.”

“Only 10 of Hepworth’s 500 cultivated acres were devoted to cannabis last fall, but this number belies how much is riding on the success or failure of the undertaking. The Hepworth sisters’ investment in marijuana goes far beyond land; they are not just growing the stuff, they have a license to process it, too.

“They have spent almost $8 million on the venture, investing in a state-of-the-art laboratory and a range of processing equipment. They have also hired a chemist, a plant biologist, marketing and sales executives, and a small army of administrators to keep up with the mountain of compliance work cannabis requires.”

“‘What’s happening here is transformational,’ Gail told me, as we watched men in backhoes digging out a foundation for an extension on the warehouse, originally constructed in the 1940s. “You could say that we’re betting the farm on it.’” READ MORE

OBITUARY

William Greenberg, Jr. fought in Patton’s army and used poker winnings to open a Manhattan bakery: “His bakery was a small space with a big name: William Greenberg Jr. Desserts, Inc. By 1971, he had expanded the company to encompass four modest locations, mostly on the Upper East Side, and employ 16 bakers. Mr. Greenberg no longer manned the ovens by then; he was the maestro in charge of the cake decorating, working mainly from what became his flagship, at 86th Street and Madison Avenue. He liked an audience as he wielded his frosting gun and often drew a crowd, including children, who would watch agape after school hoping for free samples.”

“William Jr. learned to bake from his Aunt Gertrude — at least 10 of her recipes would become part of his bakery repertoire — and at 13 he started selling cookies to his classmates.”

“He was soon baking for the Five Towns Woman’s Exchange and by 16 had hired his first employee, a classmate from home economics. He was making $300 a month selling schnecken, apple turnovers, and cookies.”

“In 1992, [Greenberg’s son] Seth bought the business outright, though his mother and father continued to work there full time. For decades the elder Mr. Greenberg had been working six days a week — often till midnight on Fridays — and he continued to do so.”

“Seth Greenberg sold the company in 1995, and the family stayed on for another two years until the relationship with the new owners soured.” READ MORE

THE 21 HATS PODCAST: DASHBOARD

The Price of Tipping, Virtual Offices, and Men’s Underwear: This week, Gene Marks explains why tipping is a terrible system that we probably will never change, why he doesn't think giving up a real office for a virtual office saved him money, and what the purchase of men's underwear can tell us about the economy. Plus: Gene says there are 27 things businesses can do with ChatGPT right now—although he does offer a few caveats.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

Thanks for reading, everyone. — Loren