It’s Rarely Been Easier to Raise Prices

Americans have become far more accepting of price hikes, but that window of opportunity may be closing.

Good morning!

Here are today’s highlights:

Are U.S. rents rising because landlords are using one company’s algorithm?

VCs have lost faith in the direct-to-consumer business model.

What can retailers learn from the Gap’s struggles?

They Got Acquired is a resource for business owners looking to sell.

THE 21 HATS PODCAST: DASHBOARD

Victor Hwang on Entrepreneurship in America: Founder of entrepreneurial advocacy organization Right to Start, Hwang suggests bipartisan policy changes that would help Americans build more businesses. He also talks about why funding of U.S. businesses is broken, what Americans really think of business owners, and what he learned about entrepreneurs on his recent cross-country roadtrip.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

PRICING

American consumers have grown more accepting of price increases—for now: “Using scanner data on prices and sales recorded with each purchase of thousands of items across more than 125,000 supermarkets, chemists, dollar stores, and big-box retailers, IRI estimates that price elasticities have fallen for 22 out of 25 product categories since February 2020, and remained flat for the other three. All told, IRI reckons that consumers were roughly 20 percent less price sensitive in the 52-week period ending September 4th than they had been in the year before the pandemic.”

“Why the shift? Experts offer three possible reasons. First, as panic-buying led to empty supermarket shelves in the early months of the pandemic, consumers adjusted their shopping routines and tried brands they weren’t used to, says Brett Gordon, a marketing professor at Northwestern University.”

“With more time at home, people also became more comfortable splurging on pricier food and household items.”

“Last, consumers cut the time they spent shopping—by roughly 9 percent between 2019 and 2021 according to government statistics.”

“There are some signs that consumers are starting to pull back. Walmart, a retailing behemoth, says that its shoppers are switching from pricey deli meats to hot dogs, and from gallons of milk to half-gallons.” READ MORE

SMALLBIZ TECH

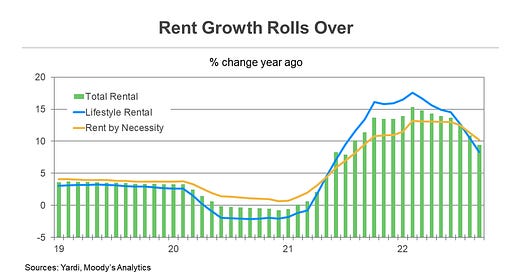

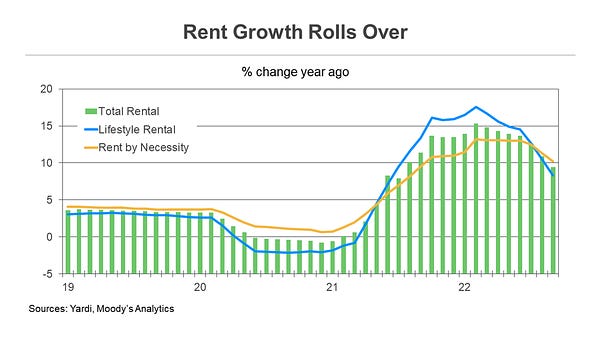

Are U.S. rents rising because landlords are using one company’s algorithm? “For years, RealPage has sold software that uses data analytics to suggest daily prices for open units. Property managers across the United States have gushed about how the company’s algorithm boosts profits. ‘The beauty of YieldStar is that it pushes you to go places that you wouldn’t have gone if you weren’t using it,’ said Kortney Balas, director of revenue management at JVM Realty, referring to RealPage’s software in a testimonial video on the company’s website.”

“To arrive at a recommended rent, the software deploys an algorithm — a set of mathematical rules — to analyze a trove of data RealPage gathers from clients, including private information on what nearby competitors charge.”

“The nation’s largest property management firm, Greystar, found that even in one downturn, its buildings using YieldStar ‘outperformed their markets by 4.8 percent,’ a significant premium above competitors, RealPage said in materials on its website.”

“RealPage became the nation’s dominant provider of such rent-setting software after federal regulators approved a controversial merger in 2017, a ProPublica investigation found, greatly expanding the company’s influence over apartment prices.”

“In one neighborhood in Seattle, ProPublica found, 70 percent of apartments were overseen by just 10 property managers, every single one of which used pricing software sold by RealPage.” READ MORE

THE ECONOMY

Economists now expect recession and job losses by early 2023: “On average, economists put the probability of a recession in the next 12 months at 63 percent, up from 49 percent in July’s survey. It is the first time the survey pegged the probability above 50 percent since July 2020, in the wake of the last short but sharp recession. Their forecasts for 2023 are increasingly gloomy. Economists now expect gross domestic product to contract in the first two quarters of the year, a downgrade from the last quarterly survey, whereby they penciled in mild growth.”

“On average, the economists now predict GDP will contract at a 0.2 percent annual rate in the first quarter of 2023 and shrink 0.1 percent in the second quarter.”

“In July’s survey, they expected a 0.8 percent growth rate in the first quarter and 1 percent growth in the second.”

“Economists’ average forecasts suggest that they expect a recession to be relatively short-lived.” READ MORE

Mark Zandi says the latest consumer-price report isn’t as bad as it looks:

SELLING THE BUSINESS

Alexis Grant is building a media business called They Got Acquired: “Through our newsletter, we share stories about online companies that have sold for six, seven, or low-eight figures, the kinds of exits that don’t typically get media attention but can be life-changing for founders, especially those who bootstrap or raise only minimal funding. We’re also building resources to help entrepreneurs sell their businesses, including a database that tracks acquisitions of this size.”

“I chose this topic because it solved a pain point I’d experienced myself: both times I sold my businesses, I didn’t know where to turn for advice or professionals to help. Most of the information I could find was geared toward much bigger sales.”

“So I set out to build this resource for entrepreneurs—but it turned out that investors, M&A professionals, and entrepreneurs looking to buy businesses are hungry for this information, too.” READ MORE

RETAIL

Venture capitalists have lost faith in the direct-to-consumer model: “Venture capital firm Forerunner has funded some of the most recognizable brands to emerge over the past decade, including luggage maker Away, cosmetics company Glossier, and high-end dog chow purveyor Farmer’s Dog. The so-called direct-to-consumer brands gained huge followings by reaching buyers directly through targeted social media tactics, bypassing the big retailers. But if you ask Forerunner partner Nicole Johnson what kind of businesses she’s looking to invest in today, direct-to-consumer startups are not very high on the list. In fact, she says she would not invest in a company pursuing a purely DTC strategy.”

“A direct-to-consumer sales channel is just ‘table stakes’ today, she says—a useful feature for a young consumer brand, but not a business model in its own right.”

“It’s a sentiment echoed by numerous VC investors that Fortune spoke to, reflecting significant changes that have altered the internet landscape, as well as the shifting mindset among private company investors at a time of economic uncertainty.”

“If direct-to-consumer startups were once touted as the harbingers of a retail revolution, today they are viewed by VCs as relics of a different era.” READ MORE

Is The Gap coming apart at the seams? “The first ever Gap didn’t carry Gap clothes. It peddled Levi’s, LPs and the idea that shopping at the store would keep you young and cool. The [San Francisco] location, which Don and Doris Fisher opened in 1969 on Ocean Avenue in Ingleside, occupied a storefront in the old El Rey Theatre, designed by accomplished San Francisco architect Timothy Pfleuger. The groovy multicolored concentric circles of the brand’s first logo were meant to replicate the records spinning inside. Today, the space remains vacant. So does the store at Powell and Market streets, which had served as the brand’s flagship until it shuttered in 2020 along with the Gap stores in Embarcadero Center and Stonestown Galleria.”

“In all fairness, Gap is facing struggles that are common to many brick-and-mortar retailers, who were coping with the rise of online shopping even before the pandemic closed stores and sent even more people to the internet for their retail needs.”

“But there’s more to the story, too. At a time in consumer culture when selling a story matters more than ever, the veteran purveyor of casual separates can’t decide what it wants to be: online retailer, mall stalwart, urban chic or discount bin.”

“The biggest mall owner in the country, Simon Property Group, has more than double the number of Gap Factory discount stores than there are Gaps, and the group is suing Gap—one of its largest tenants—over unpaid rent.” READ MORE

DESIGN

Dispensary design is no longer about lava lamps and the Grateful Dead posters: “Until now, these were the markings of marijuana dispensaries, dripping with 1960s hippie nostalgia and the musings of the stereotypical stoner, and it’s high time for the cannabis aesthetic to get a refresh, cannabis entrepreneurs say. Dispensaries and design studios are playing a game of catch up, as cannabis legalization has become more widespread across the United States in recent years. Many entrepreneurs want to strip the plant of any past negative associations, opening the door to reach new types of customers. This moment creates an opportunity to tell a brand’s story from scratch, and it’s leading to a revolution in how spaces for cannabis consumption and retail are being presented.”

“‘The retail environments for cannabis don’t match the money people are spending on it, nor do they match the diversity of the consumers,’ said Kim Myles, the co-founder of MylesMoore, a design firm that revamps the interiors of mom-and-pop cannabis dispensaries across the country.”

“For designers in the cannabis retail space, it’s not easy keeping up with rules that are constantly changing and dependent on the location. Another common regulatory challenge is that some regions don’t allow cannabis products to be visible from the street.”

“Superette, which has six locations in Ottawa and Toronto, is a playful brand that borrows elements from quotidian retail environments. One of the locations is mirrored after an Italian deli, and it has green and white checkerboard flooring, deli cases, and even tomato cans and olive oil canisters as props.”

“Another is modeled after a 1960s supermarket, and the Superette team has a Blockbuster video store themed dispensary in the works.” READ MORE

NON-HUMAN RESOURCES

Welcome to the “roboconomy:” “A combination of hard-pressed employers, technological leaps, and improved cost effectiveness has fueled a rapid expansion of the world’s robot army. A half-million industrial robots were installed globally last year, according to data released Thursday by the trade group International Federation of Robotics—an all-time high exceeding the previous record, set in 2018, by 22 percent. The total population of industrial robots in the world has now also reached an all-time high, 3.5 million, which exceeds the population of every U.S. city save New York and Los Angeles, according to the federation.”

“This all amounts to a potentially titanic shift in the way things are made, transported, and even consumed, ushering in what some who study the phenomenon call a ‘roboconomy.’”

“Even more than we do now, in the future we will depend on robots to grow our food, make our goods, care for our elderly, and continue to grow the global economy, predict researchers, economists, engineers and business leaders.”

“There’s every reason to believe the accelerated embrace of robots will continue, given the aging workforces and other demographic shifts that are driving long-term worker shortages all over the world.” READ MORE

PROFILE

In the U.K. (and in the U.S.), running a restaurant, even a very good one, is just hard: “District was a weird, magical restaurant that served delicious Thai food in the Northern Quarter of Manchester. Chefs worked on grills next to the diners. Synthwave music pumped through the room. Animations of a futuristic Bangkok were projected on the walls. There was nothing else like it in Manchester—or, I think, in the U.K. In February, less than a year after opening, District was included in the Michelin guide, whose judges praised its ‘deconstructed and re-invented Thai dishes with a classic heart.’ I ate the tasting menu there to celebrate my birthday. I’ve rarely been happier in a restaurant. On September 22nd, District’s owners sent an email, whose subject line was ‘THE END.’”

“I visited District to meet its owners: the head chef Ben Humphreys, and his business partner Danny Collins. They both looked exhausted.”

“Humphreys explained how the pair had conceived District in 2018. His wife is from Surin, in northeastern Thailand, and he wanted to create a tasting menu inspired by the Thai food he ate at home.”

“Humphreys and Collins received the keys to the site just before the first covid lockdown began, in 2020. They didn’t open until the end of May, 2021.”

“Humphreys told me he borrowed more on his mortgage, and from his family, to ride out the various covidlockdowns.”

“He remembers calling his fish supplier to say that he had made a mistake about the price of sea bass. The supplier told him there was no mistake; the price was correct. The following week, the price went up again.” READ MORE

Thanks for reading, everyone. — Loren