Skills or Personality?

With only a third of employees saying they are engaged in their jobs, more employers are looking to hire Miss Congeniality-types.

Good Morning!

Here are today’s highlights:

Only 25 percent of businesses offer 401(k) plans.

Term debt or revolving debt? It’s important to understand the difference.

Why it’s so hard to transition a family business from one generation to the next.

If we’re going to increase trade tariffs, maybe the money should be used to support small manufacturers?

MANAGEMENT

Here’s how one PE firm is training MBAs to run businesses: “San Francisco-based Alpine Investors is quickly becoming one of the most sought-after places to work for graduates of top business schools. Driving the demand is Alpine's CEO-In-Training program, which places MBAs in leading positions at companies within just a few weeks and promises to turn them into actual CEOs in a few years. For ambitious MBA students, the program offers the chance of a lifetime, although getting in is not easy. For the 2024 CIT program, which starts this summer, Alpine received 750 applications for just 12 slots, giving it an acceptance rate of 1.6 percent. Harvard, by contrast, has an acceptance rate of about 3.6 percent.”

“Success stories include David Wurtzbacher, who went from Harvard Business School to CFO of Alpine Investor's dental business to founding an Alpine-backed company that is rolling up local CPA firms in six years. In an interview with BI, Wurtzbacher described the program as ‘turbocharged entrepreneurship.’”

“The firm assesses potential hires' intellectual curiosity, emotional intelligence, and, perhaps most importantly, their ability to handle adversity. It does this through a series of short interviews, followed by a day-long interview for those who make it past the first round.”

“Grit is prized above all because even with the ‘sexy’ job title of CEO or CFO, these jobs aren't stereotypically sexy. Instead of power lunches at posh Manhattan steakhouses, Alpine's CEOs in training may be sent to small towns in rural America where they have to get their hands dirty. ‘You're moving from Yale Law School and Harvard Business School to Jackson, Mississippi, to run a plumbing company,’ [Alpine's chief talent officer, Tal Lee] Anderman said as an example.” READ MORE

HUMAN RESOURCES

Have you started making “personality hires”? “Bosses want the warm-and-fuzzies as the mood at work is generally sour. One-third of U.S. employees say they’re engaged in their jobs—near an all-time low, according to Gallup’s annual report on the state of the workforce, released this month. Half of workers say they feel a lot of stress, and 49 percent are interested in new job opportunities or actively applying. With so many lonely, unhappy charges, bosses are desperate for good workplace energy. They say camaraderie is hard to build on hybrid schedules, so they prize upbeat employees whose energy is (hopefully) infectious.”

“Businesses don’t want caricatures, but many judge applicants differently than they did during hiring sprees a couple of years ago, says Brian Vesce, co-founder and CEO of RefAssured, a candidate-reference startup. Skill was king during the talent war of 2021 and 2022, but recent layoffs suggest a lot of companies believe they have enough, or even too many, capable employees. ‘We are seeing more employers looking for the right personality when a role opens up,’ Vesce says.”

“Sensing the shift, he launched RefAssured last year in an attempt to measure characteristics in job candidates that are often called ‘intangibles.’ Using the company’s software, references answer a series of questions about how an applicant communicates, handles stress, takes feedback and manages conflict. The responses yield a candidate’s soft-skill rating on a five-point scale.”

“The concept of a personality hire—like quiet quitting and lazy-girl jobs before—crystallized on social media. Few have captured the essence better than comedian Vienna Ayla, who plays a Miss Congeniality type in skits that have been viewed tens of millions of times on TikTok and Instagram. The running joke is that her all-style-no-substance character contributes nothing, until she becomes a hero through schmoozing.” READ MORE

Gene Marks says a series of misconceptions explain why, according to a recent survey, only 25 percent of small businesses offer a 401(k) plan: “It’s true that the costs for setting up a 401(k) program at a company can range anywhere from $500 to $2,000. The annual costs paid for an outside administrator also need to be considered; most charge based on the asset values of the plan. But thanks to the 2022 Secure 2.0 Act, small businesses can receive up to $15,000 in tax credits over a three-year period to offset these costs.”

“Will employees be required to contribute? Not yet. But beginning in 2025, employers will be required to automatically enroll their new employees in their retirement plan with a minimum contribution of 3 percent of their wages.”

“Most retirement plans require the filing of annual tax returns, and plans with more than 100 participants generally require an audit. But these tasks are normally handled by an outside administrator and are generally part of the annual cost mentioned above.”

“There are incentives for both employees and employers to make contributions to a 401(k) plan. Obviously, the employee gets to save for retirement and defer their taxes. The incentive for the employer is that the more their employees contribute, the more the business owner (and their immediate family members in the business, if applicable) can contribute while still being in compliance with discrimination rules.”

“These rules test annually whether higher-paid employees are contributing an unequal amount compared to other workers. Plus, it’s a great benefit that will help to attract and retain good workers.” READ MORE

FINANCE

Ami Kassar stresses the importance of understanding the difference between term debt and revolving debt: “We’ve met clients who have shared cautionary tales that highlight what’s at stake when you use the wrong kind of debt. Someone who bought a new business using his current business’s line of credit for the bulk of his funding thought he was making a smart decision and would only be paying the interest on the purchase. But when it came time to renew that line of credit, the bank refused and the borrower had no more liquidity.”

“Term debt is a loan with a set payment plan scheduled over several months or years. For example, if you borrow $50,000 and pay the money back with monthly payments over five years, you’ll be paying an interest fee and a predictable amount of the principal.”

“Revolving debt has some important differences. It’s a loan with more flexibility regarding the timing of paying the money back—it’s like a line of credit. After you set up your revolving loan, the lender tells you the maximum you can borrow. You can borrow money whenever you need it, pay it back on your schedule, then borrow again.”

“Revolving debt usually requires you to pay the money back quickly, and many revolving lenders require that you have a zero balance at some point each year, meaning you need to pay back everything you’ve borrowed.” READ MORE

POLICY

Liz Picarazzi has a suggestion: Why not use the proceeds from trade tariffs to support small manufacturers? “In broad strokes, this is my vision: Use some of the ~$58 billion in yearly tariffs that the United States collects on Chinese imports to help small businesses manufacture domestically. Use some of it to revitalize trade education and create good jobs for young people who might otherwise be unemployed or working for minimum wage. Use some of it to build cooperative factories that small manufacturing businesses can rent from. Or more to the point: subsidize businesses like mine so I can manufacture in the USA and create jobs.”

“Tariffs won’t change the reality that there is a dearth of skilled trade workers. For 13 years I’ve had businesses that employ skilled workers and there is never enough talent in the labor market.”

“Wouldn’t it be appropriate to use the tariff funds that are collected because manufacturing is weak in the USA to strengthen manufacturing in the USA? Wouldn’t it be amazing if tariff funds were used to bring shop class back, and not track high schoolers into white collar work that AI now threatens?” READ MORE

Those smallbiz-friendly bankruptcy rules expire Friday: “The debt limit to file for Subchapter V bankruptcy is expected to revert to $2.7 million this Friday, down from the $7.5 million threshold that was established in 2020 amid the financial duress caused by the pandemic. The eligibility threshold was then renewed two years later. Subchapter V bankruptcy gets its name from a section within the U.S. Bankruptcy Code, and offers an easier avenue for business owners to file. Not only is it more affordable—we're talking hundreds of thousands of dollars cheaper here—compared with filing for Chapter 11, but it's also less time-intensive.”

“Subchapter V is far less complex than Chapter 11 as well. For starters, Subchapter V doesn't usually require a trustee, and reorganization plans are less complicated compared with Chapter 11 plans. It's also easier for a company to get back on its feet and exit bankruptcy in Subchapter V.”

“The number of small business bankruptcies has skyrocketed in recent years. Nearly 230 small businesses filed for this form of bankruptcy in May, up 53 percent compared with the same month last year, according to a report from Epiq, a New York City-based data provider.”

“In April, Senator Dick Durbin introduced the Bankruptcy Threshold Adjustment and Technical Corrections Act, which would maintain the $7.5 million debt limit for an additional two years.”

“But the bill has gained little traction since its introduction in April and with the Friday deadline looming, it appears unlikely that Congress can act swiftly enough.” READ MORE

FAMILY BUSINESS

It’s harder than people realize to transition a family business to the second and third generation: “One of the fundamental hurdles in any succession process, particularly in a family-owned business, is the current leader's readiness to step back. This could mean transitioning to an advisory role or taking a seat on the board. However, for the next generation to assume control, the current leader must be willing to relinquish management control—a task that can be more challenging than it sounds. I've witnessed cases where the next generation is ready to lead, but the current leader hesitates to step away.”

“This can ignite a significant conflict that permeates the company and the entire family, underscoring the importance of timely and effective succession planning. The crucial point is that once you announce that the current leader will step away, you've set in motion a process that cannot be reversed. This decision must be thoughtful, strategic, and real.”

“One key barrier many current leaders face when considering stepping away is whether a member of the next generation is ready to take over running the business. This can be difficult to assess. That's why many family-owned businesses embrace the best practice of having members of the next generation work outside the family business for three to five years—maybe even working several jobs—before they are deemed ready to take over running the family enterprise.”

“The worst thing you can do is have family members work only inside the business, because their ideas will be limited and constrained by their experiences. They will only know how to do what's already been done—which can stunt growth.”

“If your family business is reaching an inflection point where succession planning is becoming an issue, objectively look at the next generation of family members and ask whether they are ready to take over. You might even seek some outside counsel to check your view. If they aren't, consider bringing in a temporary CEO to manage through the transition. Or, if nobody on the horizon is qualified or even interested in taking over, maybe it's time to bring in someone permanent from outside the family.” READ MORE

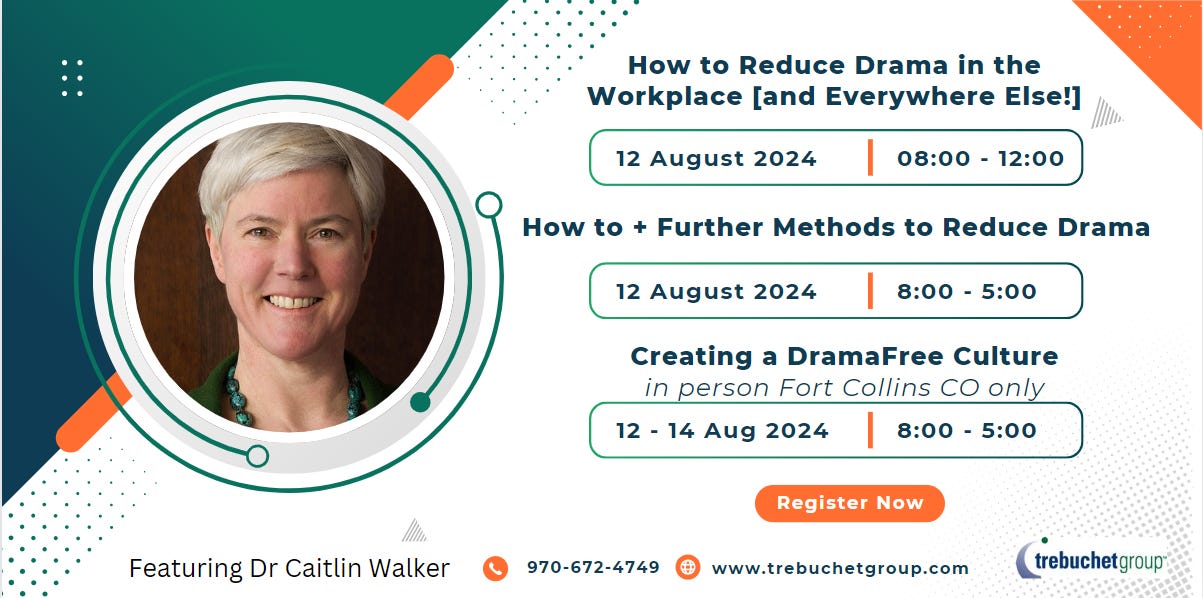

REDUCING DRAMA IN THE WORKPLACE

Every day at work, most of us experience unhelpful Drama. We misunderstand people we’re with and their behaviors, which can lead us to mislabel them and their intentions. We vent our frustrations to others, which usually ends up adding to everyone’s dissatisfaction. Or there's that problematic co-worker, the root of all of our "problems."

Chris Hutchinson’s Trebuchet Group invites you to join Dr. Caitlin Walker and their team for a series of interactive workshops August 12-14. Come learn the symptoms and the cost of drama at work, how to spot it, and learn new perspectives and tools to address drama in your workplace and life.

Come for one workshop, or build on a two-day immersive experience. Options for virtual and in-person participation. Use the code 21HATS to receive a 20 percent discount. More can be found at trebuchetgroup.com/drama-free and you can Email Diana at diana@trebuchetgroup.com with questions.

Not ready to commit to a full event?You can also see Caitlin in action at this free webinar on July 16.

THE 21 HATS PODCAST

What Will Businesses Do if SEO Dies? This week, Shawn Busse, Liz Picarazzi, and Jaci Russo talk about how the marketing world is turning upside down. For decades, business owners have treated search engine optimization as something of a religion. They may not have been able to explain it, but they had faith that, if they obeyed the rules, Google would discover their sites and rank them. But search engines are getting a lot less generous about sharing links, and Shawn fears there’s an apocalypse coming for businesses that rely too heavily on SEO. Jaci’s a little more optimistic: “There'll be some other places to go get free traffic,” she says. “There always are.”

Plus: Liz gives us an update on her recent trip to Vietnam in search of a contract manufacturer. And in a case study ripped right from the subreddit headlines, I ask the three owners: What do you do if a loyal, hard-working employee starts a side hustle selling a product that doesn’t compete with your product but looks a whole lot like it?

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

Thanks for reading, everyone. — Loren