The Big Advantage of Patronizing Small Businesses

Jason Fried says business owners should think carefully about where they spend their money.

Good Morning!

Here are today’s highlights:

More small businesses are raising capital from customers.

The pandemic has accelerated the shift to digital payments.

Are you paying attention to how big companies are handling pricing?

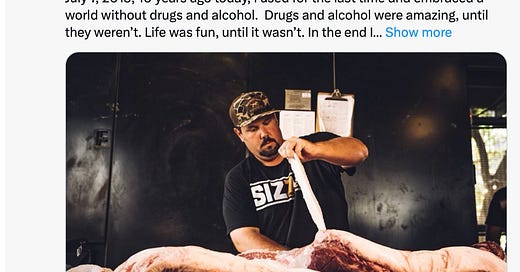

A prominent restaurateur decides to talk about his struggle with addiction and his 10 years of sobriety.

VENDORS

Jason Fried writes about how hard it used to be to find a decent payment service—and how important it is to think about where you do business: “While you were never really happy with the service, you had to have it. And switching to another service meant going through the whole ungainly process again. And the grass was probably browner. However, one day a fellow named Bryan Johnson reached out. He started a company called Braintree that processed credit cards. I can't remember exactly what made them different, although they certainly felt more ‘modern.’ Their API looked like it had been written recently, rather than back in the ‘80s like JP Morgan's. But more than that, we liked Bryan. He was clearly competent, he was local, he wasn't afraid of the internet, he was aware of what we did, what we were trying to do, and who we were. He wasn't a sales guy trying to close a deal, he was a CEO trying to build his own business. That meant something to us. So we gave them our business. And nearly two decades later, we're still with them today.”

“This whole experience made a major impression on me. It made me really appreciate who we did business with. And even in my personal life, who I do business with. Can I reach the owner? Can I email the CEO? Who's over there working for me vs. just selling me and moving on?”

“This is one of the reasons I really value doing business with smaller businesses—typically founder-led, or owner-involved companies, companies that may have structure, but they'll part it like the Red Sea when a customer needs access to the top.” READ MORE

PAYMENTS

For many owners, the pandemic accelerated the shift to digital payment: “Small-business owners increasingly are making the switch to cashless payments for several reasons, including rising consumer demand, faster checkout, lower labor costs and increased security. Those who wait risk losing revenue, experts say. But there are drawbacks to going cash-free, including a learning curve for entrepreneurs who may not understand how to set up digital payments, a lack of accessibility to credit cards for low-income consumers, and privacy concerns.”

“Juanny Romero was an early adopter of digital payments for her small business. Fifteen years ago, when she founded Mothership Coffee Roasters, a chain of coffee shops in Las Vegas, she began using Square, a low-cost digital payments system for small businesses. ‘I was a young businesswoman and not astute,’ she said. But Square saved her $3,000 a month in merchant fees for credit card processing.”

“The pressure to adapt is growing. More that 2.8 billion mobile wallets were in use at the end of 2020, and that is projected to increase nearly 74 percent to 4.8 billion — nearly 60 percent of the world’s population — by the end of 2025, according to a study released in 2021 by Boku, a fintech company.” READ MORE

FINANCE

More small businesses are raising capital by selling bonds to their own customers: “As it gets harder for small businesses to land conventional loans, more of them are turning to a new source of funding: their customers. Using a relatively little-known financing tool, businesses are able to sell bonds to hundreds of customers and community members—with some investing as little as $10. These businesses are capitalizing on a regulatory change that lets them solicit investments from nonaccredited investors—those with relatively modest income or assets. As they have watched beloved local businesses struggle since the pandemic began, these investors see the bonds as a way to support those businesses while also generating a financial return.”

“When Palm City Wines set out to raise $250,000 by issuing a small-business bond in April, Kashuk pledged $200. Within five days, the Palm City Wines bond—which pays 9.5 percent interest on customers’ investment monthly over five years—was oversubscribed. The company increased the cap on the amount it could raise, ultimately raising more than $400,000.”

“Dennis Cantwell, co-founder of Palm City Wines, says that the money raised will enable it to open a second store. Having taken a Small Business Administration-backed loan to open the first branch of Palm City Wines, Cantwell says that he had no more collateral to offer to a bank for a second loan.” READ MORE

Looking to raise capital? Get a tattoo: “According to a new study, entrepreneurs running crowdfunding campaigns do better if they show people with tattoos in their online pitch materials. And showing tattoos is especially helpful if the campaign is for a product that is not particularly artistic. For instance, a non-artistic product like new night-vision binoculars would get more of a boost from showing people with tattoos than something artistic like a coffee-table book. That is likely because potential backers may interpret tattoos in a non-artistic campaign as a signal that the person running the campaign is creative—and the perception of creativity makes people more likely to contribute, research shows. For an artistic campaign, though, people likely already think the project is creative, so the tattoos don’t help as much.”

“The team began by downloading a random sample of 1,500 campaigns posted to the Kickstarter crowdfunding site. They took out any campaigns that didn’t include at least one picture of humans, and they sorted the 619 remaining campaigns into artistic and non-artistic groups, based on Kickstarter’s product categorization. As it turned out, tattoos helped all types of campaigns.”

“For artistic campaigns, showing people with tattoos brought in 128 more backers on average than campaigns where tattoos weren’t shown. For no-artistic campaigns, the presence of tattoos helped even more, attracting 458 additional backers on average. Moreover, for non-artistic campaigns, revealing tattoos translated into a steep increase in total dollars pledged—nearly $27,000 in more funds raised, on average, than non-artistic campaigns that displayed no tattoos.” READ MORE

PRICING

The big boys are selling less but profiting more: “PepsiCo reported a big jump in quarterly profit on Thursday, despite signs that customers are buying fewer cans of soda and bags of chips as the company continues to raise prices aggressively. Pepsi, which makes Gatorade, Lay’s, and Quaker Oats, also raised its forecast for earnings in the rest of the year, pushing its stock higher.”

“Though Pepsi earned more last quarter, the amount of products it sold went down. The prices of its products have risen by double-digit percentages for the past six quarters, and the company has reported dipping sales volumes for the past three quarters.”

“Pepsi’s prices overall were 15 percent higher in the second quarter than they were a year earlier. The increase was particularly pronounced in Pepsi’s European division, up 20 percent.” READ MORE

RESTAURANTS

A prominent pitmaster decides to talk about his 10 years of sobriety:

MANUFACTURING

Can $100 billion save a Rust Belt city? “For now, the thousand acres that may well portend a more prosperous future for Syracuse, New York, and the surrounding towns are just a nondescript expanse of scrub, overgrown grass, and trees. But on a day in late April, a small drilling rig sits at the edge of the fields, taking soil samples. It’s the first sign of construction on what could become the largest semiconductor manufacturing facility in the United States. Spring has finally come to upstate New York after a long, gray winter. A small tent is set up. A gaggle of local politicians mill around, including the county executive and the supervisor of the town of Clay, some 15 miles north of Syracuse, where the site is located. There are a couple of local news reporters. If you look closely, the large power lines that help make this land so valuable are visible just beyond a line of trees. Then an oversize black SUV with the suits drives up, and out steps $100 billion.”

“The CHIPS and Science Act, passed last year with bipartisan congressional support, was widely viewed by industry leaders and politicians as a way to secure supply chains, bolster R&D spending, and make the United States competitive again in semiconductor chip manufacturing. But it also intends, at least according to the Biden administration, to create good jobs and, ultimately, widen economic prosperity.”

“Now Syracuse is about to become an economic test of whether, over the next several decades, the aggressive government policies—and the massive corporate investments they spur—can both boost the country’s manufacturing prowess and revitalize regions like upstate New York. It all begins with an astonishingly expensive and complex kind of factory called a chip fab.” READ MORE

PROFILE

Finding an entrepreneurial alternative to coal mining: “Rick Johnson’s introduction to the world of coal began as a teenager more than 40 years ago in rural western Virginia. For a decade and a half, he worked for extraction and chemical production companies across Appalachia. ‘I was fed on coal,’ he said recently. But his work kept him away from home for long periods. And by the mid-1990s he and his wife, Heather, saw another major resource staring them in the face: the region’s natural beauty. As the once-profitable local mining and extraction industry suffered a downturn, leading company after company to board up, the Johnsons decided to buy a rafting business in Oak Hill, West Virginia.”

“Today, Johnson employs 110 people at River Expeditions, a company that takes people on guided rafting trips down the whitewater rapids of the Gauley and New rivers. Their sprawling resort also has zip-lining, horse riding, and cabins, serving as an important source of jobs for locals in a region grappling with high unemployment.”

“‘It’s hard for people to stay [in West Virginia] and make a living. There’s just not that much to offer,’ he says. ‘I wanted to see this area grow to where kids didn’t have to leave here to get a job.’”

“‘Tourism is the only thing we’ve ever had in central Appalachia that the resource renews itself every day and the money stays here,’ Johnson said. ‘That’s what’s so beautiful about it.’” READ MORE

The second-generation owners of 99 Ranch are going national: “For many Asian Americans across California, 99 Ranch is much more than just a grocery store. It’s a pilgrimage. When I was a child growing up in the San Fernando Valley in the 1990s, my Taiwanese parents would drive over an hour east to the San Gabriel Valley every single weekend just to shop at 99 Ranch. They’d load up on squirming live shrimp, jadeite bundles of water spinach and fat, oblong lotus roots. For them, it was a refuge where they could indulge in the flavors of their native Taiwan. While there were plenty of Asian supermarkets to choose from in the ’90s, we always went to 99 Ranch because they had the largest and best selection of goods. Right before we hit the cashier, my brother and I would each get a singular pick of something sweet.”

“‘I loved the White Rabbit candy,’ says Jonson Chen, citing a sweet milk candy from Shanghai. Mustached with slicked-back hair, Chen is the chairman of 99 Ranch Market. I meet him and his sister, Alice Chen, the company’s chief executive, inside their newest store location in Eastvale, a 50,000-square-foot compound including a warehouse and a food hall that is set to open next month. The Chen siblings represent a new generation of leadership at the nearly 40-year-old grocery chain, helming its expansion across the United States.”

“The first 99 Ranch was opened in 1984 in Westminster by Jonson and Alice’s father, Roger Chen, a Taiwanese immigrant from the western city of Taichung. Headquartered in Buena Park with 58 stores in 11 states, it is now one of the largest Asian supermarket chains in America.”

“As children, neither Jonson nor Alice anticipated taking over their dad’s company. Their father never pressured them to work for him, but always kept the door open in case they showed interest. They tell me that while they grew up with the grocery store, it took a while for them to realize just how big the brand had gotten.” READ MORE

THE 21 HATS PODCAST

‘You’re in the Valley of Death:’ This week, Shawn Busse, Jay Goltz, and Jennifer Kerhin talk about that difficult transition when the owner of a growing business can no longer handle all of the most important tasks herself but also can’t quite afford to hire the people she needs to lighten her load. It’s part of the reason Jennifer, as she’s told us in previous episodes, has been working 12-hour days, six days a week. It’s a challenging transition, and it has a name: It’s the “valley of death,” says Shawn, who compares it to crossing a desert. We also discuss how big the owners want their businesses to get, why important tools and processes seem to break with every $500,000 of revenue growth, and what constitutes the proper care and feeding of salespeople.

Plus: Jay has an idea for owners who are having a hard time selling their businesses. The idea involves selling the business to a key employee in a transaction Jay is calling a WE-SOP. Get it? It’s kind of like an ESOP, but it’s a lease-to-own version of an ESOP. A WE-SOP.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

Thanks for reading, everyone. — Loren