Trash, Rats, and Garbage Juice

In our latest podcast, Liz Picarazzi offers a case study in managing negative publicity.

Good morning!

Here are today’s highlights:

Are small businesses facing a looming debt crisis?

An analysis breaks down how inflation has upended operations at one restaurant in North Carolina.

The survival of New York City’s Chinatown businesses may depend on figuring out succession.

Some startups are allowing employees to set their own salaries.

THE 21 HATS PODCAST

Trash, Rats, and Garbage Juice: A Case Study in PR. This week, Liz Picarazzi tells Jay Goltz and Sarah Segal about her first brush with bad publicity. Liz’s debacle started with a negative post that appeared in a prominent local blog. It was about a Times Square pilot program for which her business, Citibin, is supplying trash bins. The problem? The bins were not being maintained properly, and there were photos to prove it. At the time we recorded this conversation, Liz was bracing for additional stories in both the New York Post and The New York Times. Both of those stories have since been published—we’ll talk about them in a coming episode—and you can find links to all of the coverage in the show notes. For Liz, perhaps the biggest challenge was defending her company without trashing her client.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

FINANCE

In San Francisco, businesses are experiencing a growing debt crisis as payments come due for PPP and EIDL loans: “[McTeague’s Saloon] was one of the more than 60 percent of applicants for the $28.6 billion Restaurant Revitalization Fund, a federal restaurant relief pool established in March 2021, that got nothing from the program. [Owner Fiachra] O’Shaughnessy did receive money from the earlier Paycheck Protection Program, but mandated closures for bars—combined with a caveat that a certain amount must be spent on wages—meant that more than a quarter of the $220,000 McTeague’s got in federal PPP money wasn’t forgiven. The bill came due in June as the bar continues to limp at around 40 percent of pre-pandemic levels, said O’Shaughnessy.”

“As hopes for more federal aid dwindle, so is the cash from the $750,000 Economic Injury Disaster Loan the bar took out to get it through the pandemic.”

“McTeague’s story is emblematic of a simmering debt crisis that is threatening to boil over and wipe out a host of small businesses across San Francisco.”

“‘There are so many people in the same boat as us,’ O’Shaughnessy said. ‘Then there were people who made an even bigger mistake, folks who got a second loan on their house. They’re going to have an even tougher time with this.” READ MORE

THE ECONOMY

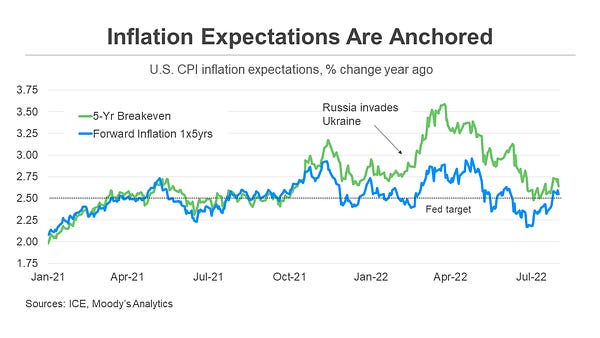

Mark Zandi no longer believes that a recession is inevitable:

The New York Times breaks down how inflation has affected a restaurant in Charlotte, N.C.: “The menu at Good Food on Montford, one of three restaurants Mr. Moffett owns, centers on creative small plates, from spice-rubbed pork buns to green tomato focaccia. They call for a wide variety of ingredients, many from local purveyors like Boy & Girl Farm. Prices have skyrocketed for the marquee proteins, like beef and pork, in the most popular dishes. Mr. Moffett lays much of the blame on the pressing demand for workers: ‘There is a shortage of truck drivers. There is a shortage of people working in the factories. There is a shortage of people working in the fields.’”

“He has raised the price on the restaurant’s Korean beef with crispy rice to $16. In 2019, just before the pandemic, it cost about $12.”

“‘‘I have always been able to keep our labor around 22, 24, 25 percent’ of the restaurant’s monthly budget of roughly $125,000, said Elizabeth Tackett, the general manager. ‘We are absolutely pushing past 30 percent, with no end in sight.’”

“The restaurant makes nearly $2 million a year in sales; Mr. Moffett estimates that his profit margin has fallen about 8 to 10 percent, from roughly 15 to 20 percent before the pandemic.”

“The average pretax profit margin for the typical restaurant with annual sales of $900,000 has dropped to around 1 percent from about 5 percent, according to the National Restaurant Association.” READ MORE

HUMAN RESOURCES

Nationally, wages have risen more than 5 percent year over year every month this year: “Average hourly earnings grew 5.2 percent in July from a year earlier, and annual wage gains have exceeded 5 percent each month this year, the Labor Department said Friday. The rapid earnings growth adds to other evidence that employers are continuing to increase pay as they try to find and keep workers in a tight job market.”

“‘The entire cost structure of operating a business has increased, including wages,’ said [Omair Sharif, head of forecasting firm Inflation Insights]. ‘That’s allowing firms in a high-inflation environment to pass those costs on to consumers.’”

“‘Workers are still willing and confident enough to leave their current job to look for another one,’ said Kathy Bostjancic, economist at Oxford Economics. ‘Part of the reason to do that is to seek out higher wages.’”

“Job switchers are contributing to overall wage growth as they reap bigger pay increases and put pressure on employers to raise pay for existing employees.” READ MORE

In Massachusetts, a $50 million program to help businesses hire and train has disappointed many businesses: “When Jordan Mackey heard this spring that the state was making $50 million available to help with hiring bonuses and training for new employees, he thought the timing couldn’t have been better. He was getting ready to open his second Nan’s Kitchen & Market off Route 9 in Southborough, a project that had been waylaid by the COVID-19 pandemic. Mackey quickly did the math: With the promise of a $4,000 grant per new employee from the new program, dubbed HireNow, he figured he’d get at least $150,000 to help pay for training for the 39 people he planned to bring on board to staff the new restaurant and two existing ones, a Nan’s in Stow and Sobre Mesa in Sudbury.”

“Instead, he found out he won’t get a single dime, even though he registered in April. ... The program was swamped and is now closed. Mackey said he was told it would last until the end of the year.”

“‘This grant was going to help us move quicker and create more jobs, faster,’ Mackey said. ‘Having these funds available to help with training was an unbelievable gift. [But] we just didn’t hear anything from anybody until it was, Sorry, you’re out of luck, you’re not getting any money.’”

“Mackey is just one of many small-business owners who received that bad news in the past two weeks. The primary culprit? Huge demand.” READ MORE

SUCCESSION

The survival of New York City’s Chinatown businesses may depend on finding the next generation of owners: “After commissioning research by the consultancy HR&A, canvassing 152 small businesses, and conducting bilingual focus groups, local nonprofit Welcome to Chinatown concluded that Chinatown’s immigrant-run industries are ‘extremely at risk’ of disappearing. The study also reveals that Chinatown’s workforce has been hit far harder by the pandemic than the rest of New York City. ... Chinatown’s survival depends in large part on whether legacy business owners can hand the reins to the next generation. But most Chinatown businesses lack succession plans, said Lee. Creating them needs to become an urgent priority.”

“‘As the business owners continue to age in the next three to five years, without a game plan we’ll start to see more and more vacant storefronts, and we’ll start to lose the community,’ she said.”

“‘It’s becoming difficult to stay a small-property owner,’ she said. ‘They’re more inclined to sell. And when they sell, they’re selling out to larger developers that might want to turn it over to a higher-paying tenant, which means we’re at risk of losing existing commercial tenants.’” READ MORE

STARTUPS

Some European startups are allowing employees to set their own salaries: “Before introducing self-set salaries, Ragnarson had already ‘opened up’ its budget to employees in 2014 to show them how the company was performing financially and educate them on its revenue, costs and profit. Everyone knew what the other was earning, and the company spent time looking at the team’s salaries and ironing out any discrepancies. The company later transitioned to self-set salaries in 2017, with the aim of delegating more responsibility to employees. At first, staff were confused, if not alarmed. ‘Their reaction was like, what does this mean? What do you expect me to do? So now I can pick my own salary? Are you crazy?’ says Gałkiewicz.”

“The process of self-setting salaries varies across companies. But generally, the employee spends time researching what others in similar roles are paid in the wider market.”

“The employee shares their business case with the wider team and receives feedback about whether or not what they are asking for is fair. This could be a formal committee at a bigger company, or just a Slack chat at a smaller one.”

“Based on this input, the employee then makes the final decision on what their salary should be.” READ MORE

John Mackey, co-founder of Whole Foods, is starting a new food and wellness venture: “Corporate records list Mackey, 68, as a partner in Healthy America, a startup that raised about $31 million from investors earlier this year and aims to launch a ‘national network’ of medical wellness centers and vegetarian restaurants. ... The first Health America location, under the brand Love Life!, is expected to be in southern California, according to a person familiar with the plans, who requested anonymity because they weren’t authorized to discuss them publicly. A bare-bones Love Life website teases a 2023 launch date and asks visitors to sign up for updates.” READ MORE

THE 21 HATS PODCAST: DASHBOARD

Dashboard: Why Gene Marks Hates Employees, Part 492: This week, Gene talks about how he recently had a mild case of Covid but worked right through it, which got him to wondering why employees—in his view—do not seem to be similarly dedicated. In fact, Gene believes that many employees are using ‘Covid hysteria’ as a pretext to avoid work and catch up on their TV watching. Plus, Gene explains why he thinks Wawa, a chain of convenience stores, is a good model for his own business. And he tries to make sense of a recessionary economy that produced more than half a million jobs in July.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

If you see a story that business owners should know about, hit reply and send me the link. If you got something out of this email, you can click the heart symbol, you can click the comment icon below, and you can share it with a friend. Thanks for reading, everyone. — Loren

Loren, I was listening to (and loving) this week's podcast and I could directly relate to Sarah's dilemma with companies ghosting her after a pitch. Possible solution...

As Sarah mentioned, preparing a proposal for a prospect is fairly costly and the post-pitch ghosting can be quite frustrating. I was a marketing consultant for over 10 years and a few years ago, at the recommendation of some peers, I started charging for my proposals. If a company wanted me to look at their marketing plan and come up with a strategy or ad campaign, I would charge a minimum of $1500 for the proposal and that amount would be credited towards my services if I won the contract.

My reasoning was that if a company was serious about evaluating my services, they would understand the value of the proposal and would be willing to pay one or more agencies/consultants to pitch them. This worked very well for me.

So, this is just an idea that might be a good compromise solution for Sarah for new prospects = it compensates her company for the time/effort of the pitch and weeds out the tire-kickers and idea-stealers.

(BTW, as Sarah mentioned, some unscrupulous business owners use the agency pitch process to gather free marketing ideas with no intention of hiring an agency. This is hopefully only a small number, but it happened to me a few times and I even heard some companies bragging about their shrewdness in doing this lol.)

Anyway, keep up the great content and doing what you do!