When You’re Really Married to the Business

Partnership is rarely easy. This week on the podcast, the owners talk about the joys and challenges that arise when your partner is also your spouse.

Good morning!

Here are today’s highlights:

There’s no advertising slump on TikTok.

How far will companies go to get employees back into the office?

The big tech companies are freeing up a ton of office space.

Here’s a quick summary of the FTX collapse and what it means for crypto. (Really quick summary: you can continue ignoring crypto.)

THE 21 HATS PODCAST

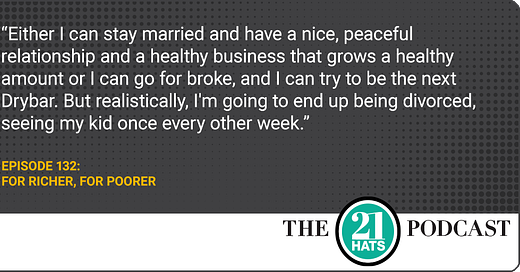

For Richer, For Poorer: This week, Liz Picarazzi, Hans Schrei, and Laura Zander talk about something they have in common: They all own and run their business with a partner who also happens to be a spouse. Which suggests some interesting questions: Is someone in charge? How do they divvy up responsibilities? What do they talk about? What do they fight about? Do they fight in front of the employees? How do they make decisions? Who does the dishes? Do they ever wish they were not in business with their spouse? Do they know what would happen to the business if they were to divorce?

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

MARKETING

Digital advertising platforms are slumping—except for TikTok: “Last month, Tiffany & Company shared a sleek black-and-white video featuring the pop superstar Beyoncé dripping in gems and surrounded by nightclub revelers. The minute-long jewelry ad was posted on Instagram, where it drew 1.6 million views. A week later, Tiffany posted a different video on TikTok, the viral short-video app. That ad showed the social media personality Kate Bartlett talking directly to viewers from a bathroom and then trying on small trinkets at a Tiffany store. It has been watched more than 5.2 million times.”

“This year, TikTok is on track to make nearly $10 billion in ad revenue, more than double what it generated last year, according to estimates from the research company Insider Intelligence.”

“Many advertisers have concerns about TikTok and its Chinese owners, its struggles with content quality and its problems with bot traffic. But companies keep flocking to the app, which says it has more than one billion users, because it appears to have reach and cultural cachet, particularly among young adults.”

“TikTok’s users spend an average of 96 minutes a day on the app —nearly five times what they spend on Snapchat, triple their time on Twitter and almost twice as much as their time on Facebook and Instagram, according to the data analytics company Sensor Tower.”

“‘TikTok is eating the world. The only thing that matters in the world of entertainment is time spent,’ said Rich Greenfield, a technology analyst at LightShed Partners.” READ MORE

HUMAN RESOURCES

Here’s how one company is getting workers back into the office: “In L’Oréal’s plush new West Coast headquarters in El Segundo, workers are pampered by a concierge who will fill their cars with gas, pick up their laundry, retrieve their dogs from day care or do any other task employees want. Personal and professional chores are fulfilled for $5 an hour, freeing employees to concentrate on their jobs in a former aircraft factory turned office building that now sports such comforts as a fitness center, restaurant, juice cafe, and a cabana-like bar that serves coffee drinks and, depending on the occasion, alcohol.”

“People work where they wish on the campus, even outdoors, where a park-like setting is served by company Wi-Fi and a vegetable garden grows fare employees can take home. Dogs are welcome inside and out.”

“L’Oreal’s sweet setup reflects a carrot-and-stick approach being used to get people back to the office as pandemic concerns wane among employers. Lure them to work, the thinking goes, by making it a place they want to be.” READ MORE

OFFICE SPACE

As the big tech firms downsize, they are flooding business districts with office space: “While leasing from all businesses declined during the pandemic, the tech sector accounted for the largest portion of the leasing that took place, according to real estate services firm CBRE Group Inc. Some tech companies, such as Alphabet Inc.’s Google, continued to expand their office footprints during that period. Now, with the prospect of a recession looming and companies slashing payroll, tech firms find they have too many floors of office space and want to unload big chunks of it. Companies in the technology sector have placed about 30 million square feet of office space on the sublease market, more than triple the 9.5 million square feet they looked to sublet in the fourth quarter of 2019, according to CBRE.”

“‘Downsizing is much more of a threat than work from home,’ said Nicholas Bloom, an economics professor at Stanford University.”

“Big tech’s retreat is a blow to the office market and to many city economies, which for several years have counted on the sector’s real estate appetite to power growth.”

“The national office vacancy rate is 12.5 percent, up from 9.6 percent in 2019 and the highest since 2011, according to data firm CoStar Group. Overall, about 212 million square feet of sublease space is on the market, a record since CoStar started tracking the statistic in 2005.” READ MORE

THE ECONOMY

Covid is still confusing people: “Restaurants are packed, and cultural performances sold out. Children are sitting in schools, and workers are trickling back into offices. Masks are no longer required in public, even in New York City’s subways. The summer travel season was a blockbuster. Even cruise ships — derided as floating Petri dishes early in the pandemic — were filling up with eager passengers. Most Americans want to get back to normalcy and are unwilling to let Covid rule their lives any longer, Dr. Ashish Jha, the White House Covid response coordinator, said in an interview.”

“‘Those two sets of goals are achievable,’ Dr. Jha said, so long as Americans keep getting vaccinated, test when necessary and wear masks in crowded public settings. ‘We shouldn’t act like it’s 2019,’ he added, ‘but we also should not act like it’s 2020.’”

“While deaths have plummeted since the beginning of the year, about 315 Americans are still dying of Covid on the average day. This year’s toll has so far exceeded 219,000.”

“More than 27,000 Americans with Covid are in hospitals on any given day, and an uncertain number face lingering complications, so-called long Covid. Declines in test positivity and hospitalization are flattening, hinting at a possible reversal.” READ MORE

LOGISTICS

Here’s how one small importer tried to fight the cargo giants: “Here was a minnow picking a fight with a whale. [Jacob] Weiss’s company, OJ Commerce, is modest in size. Hamburg Süd is a subsidiary of Maersk, a publicly traded Danish conglomerate that is the second-largest container shipping company on earth, with annual revenues exceeding $61 billion. The result of the letter was swift and decisive — though not in the way that Mr. Weiss intended. Hamburg Süd halted negotiations with his company over a new contract for the next year. The actions of Hamburg Süd, which Mr. Weiss describes as retaliation for his decision to protest mistreatment, attest to the power of the carriers that dominate ocean transport, challenging the Biden administration’s promises of a crackdown on bad behavior.”

“After Hamburg Süd terminated negotiations on a new contract last year, OJ Commerce filed a complaint at the [Federal Maritime Commission], seeking more than $22 million in damages. A verdict is expected late this year, but OJ Commerce has already endured a time-consuming, expensive court process fighting the carrier to turn over documents relevant to the case.”

“Hamburg Süd would be paid about $1,800 to ship each 40-foot container, which held most of the furniture and household goods that OJ Commerce would sell under its own brands. The carrier delivered only 185. That forced OJ Commerce to pay vastly inflated prices to lock up last-minute bookings for its additional containers.”

“The complaint claims that Hamburg Süd denied OJ Commerce’s containers so it could cash in on soaring shipping rates, selling the same space to other importers for 10 times the contracted price.” READ MORE

AGRICULTURE

Farmland values are surging, and small farmers are getting priced out of the market: “Joel Gindo thought he could finally own and operate the farm of his dreams when a neighbor put up 160 acres of cropland for sale in Brookings County, S.D., two years ago. Five thousand or six thousand dollars an acre should do the trick, Mr. Gindo estimated. But at auction, Mr. Gindo watched helplessly as the price continued to climb until it hit $11,000 an acre, double what he had budgeted for. ‘I just couldn’t compete with how much people are paying, with people paying 10 grand,’ he said. ‘And for someone like me who doesn’t have an inheritance somewhere sitting around, a lump sum of money sitting around, everything has to be financed.’”

“What is happening in South Dakota is playing out in farming communities across the nation as the value of farmland soars, hitting record highs this year and often pricing out small or beginning farmers.”

“In the state, farmland values surged by 18.7 percent from 2021 to 2022, one of the highest increases in the country, according to the most recent figures from the Agriculture Department.”

“Nationwide, values increased by 12.4 percent and reached $3,800 an acre, the highest on record since 1970, with cropland at $5,050 an acre and pastureland at $1,650 an acre.” READ MORE

CRYPTO

If you’re trying to catch up, here’s a quick overview of the FTX collapse: “In less than a week, the cryptocurrency billionaire Sam Bankman-Fried went from industry leader to industry villain, lost most of his fortune, saw his $32 billion company plunge into bankruptcy and became the target of investigations by the Securities and Exchange Commission and the Justice Department. But in a wide-ranging interview on Sunday that stretched past midnight, he sounded surprisingly calm. ‘You would’ve thought that I’d be getting no sleep right now, and instead I’m getting some,’ he said. ‘It could be worse.’”

“The empire built by Mr. Bankman-Fried, who was once compared to titans of finance like John Pierpont Morgan and Warren Buffett, collapsed last week after a run on deposits left his crypto exchange, FTX, with an $8 billion shortfall, forcing the firm to file for bankruptcy.”

“The damage has rippled across the industry, destabilizing other crypto companies and sowing widespread distrust of the technology.” READ MORE

THE 21 HATS PODCAST: DASHBOARD

How Gene Marks stopped sweating health insurance: You want to negotiate with Blue Cross every year? Go ahead. Gene Marks says he's found an alternative that he believes allows him to take care of his employees without the hassle of actually buying health insurance. Plus: Why Gene doesn’t discount his services for nonprofits and what he thinks is the most important takeaway for business owners from last week’s midterm elections.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

Thanks for reading, everyone. — Loren