Why Advertisers Are Leaving Pinterest

As budgets tighten, the focus shifts from brand awareness to the bottom of the funnel.

Good Morning!

Here are today’s highlights:

Is the SBA sending the wrong message by not trying harder to collect PPP loans?

This could still be a good time to sell your business.

Remote workers get flexibility but lose the opportunity for feedback.

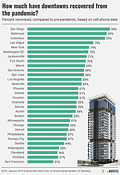

Which cities have had the best recoveries?

MARKETING

Some brands are backing away from Pinterest: “One agency head who did not wish to be named told Modern Retail that 10 clients, or around 25 percent of the agency’s overall portfolio pulled out of running paid ads on Pinterest this year. The founder of e-commerce agency Commerce Canal also told Modern Retail that Pinterest spending has dropped significantly this year, and that its clients are spending 32.4 percent less on the platform versus the same time last year. As a result of the economy’s perceived weakness, agency heads said that brands have started to focus more on the bottom of the funnel marketing channels. Because of that, Pinterest — a channel that brands have long struggled to attribute sales to — is no longer making the cut for some companies.”

“Last year, Pinterest appointed senior Google executive Bill Ready as chief executive officer to lead a new phase of growth for the company by encouraging more shopping on Pinterest. This year, to further build its shopping intent Pinterest said it is encouraging merchants to upload their catalogs on the website, and helping advertisers test new formats like Premiere Spotlight.”

“Among his clients, Pinterest spend has decreased dramatically this month compared to the same time last year, said Commerce Canal founder Ryan Craver. ‘What I’ve definitely seen over the course of the last several months is, as people have pulled back, they have pulled back on platforms that have shown weak attribution. And the attribution and the return on Pinterest is definitely much much lower relative to the more concrete numbers coming from Meta, Google, and Bing,’ Craver said.”

“Historically, Craver said that Pinterest is more about driving awareness about a brand, as opposed to more bottom-of-the-funnel platforms like Meta and Google. Still, some smaller brands see merit in investing in Pinterest, because it allows them the flexibility to work with smaller budgets.” READ MORE

FINANCE

The SBA’s watchdog is calling out the agency over PPP loan collection: “The Small Business Administration’s inspector general believes the agency can do a lot more to recover money on delinquent Paycheck Protection Program loans — and said it will send the wrong message if the SBA doesn't take those steps. The SBA has drawn heat from multiple corners for its approach to delinquent loans from its Covid-19 relief programs. The agency has said it wouldn't continue pursuing collections on a number of smaller loans, noting the costs of collection would often be more than the amount at stake.”

“In addition to scrutiny from Congress, the decision has also led many business owners to question what the fallout will be if they don't or can't pay. SBA Inspector General Michael Ware said in a recent hearing that the SBA should make every effort to collect.”

“‘There are really simple avenues to make an attempt to collect that money. I believe it sends a terrible message relative to how seriously we take that,’ Ware said. ‘I believe it sends a detrimental message to any future emergency programs or any programs across the government.’”

“The SBA decided in April 2022 to formally end collections on all loans below $100,000 — with about 59,000 PPP loans SBA had purchased from lenders falling into that category as of June 30. That represents about $1.1 billion in loans.” READ MORE

SELLING THE BUSINESS

Is now a good time to sell? With the recent fallout of Silicon Valley Bank, some entrepreneurs who’d planned to sell are asking whether now is still the right time. The truth is, whether it’s the right time to sell your company is based on lots of factors. Yes, market outlook is one of them, but you also want to consider the performance of your business, trends in your particular space, and your own personal bandwidth for continuing to grow the company. Still, we hear business owners digging on whether it’s a seller’s or buyer’s market, how the SVB fallout is affecting the acquisition landscape, and how you should navigate current market conditions. We asked players in the space, including M&A brokers and active buyers, some of your burning questions:”

“‘The market is generally still stable but naturally there is an undercurrent of nerves and the froth has definitely come off the top… Multiples are starting to come down, businesses are staying on the market longer, and sellers are typically accepting less cash up front, but it is still a seller’s market. It’s not a terrible time to sell, but not as frothy as 2021.’– Dominic Wells, founder of Onfolio, a firm that buys online businesses.”

“‘The market has been slow compared to previous years. We still have buyers looking to buy businesses, but sellers have been slow on making decisions to move forward to sell their business. With the increase in interest rates, the weak economy, and what I am calling ‘PTSD’ following Covid, it is causing fear and doubt with our sellers and buyers.’ – Marla DiCarlo, CEO of Raincatcher, a brokerage that helps business owners sell.”

“‘Still a very hot seller’s market. We’ve actually seen an increase due to business acquisitions becoming very hot and trendy.’ – Christine McDannell, business intermediary at The Magnolia Firm, a brokerage that helps founders sell.” READ MORE

THE 21 HATS PODCAST: DASHBOARD

America’s Economy Is Better than Americans Think: Yes, demand is tapering, and a recession is looming, says Gene Marks, but this is a great economy and a great country and everyone should stop complaining! Plus: Gene explains how some business owners get the state to pay for their employee training, how restaurants are finally adopting technology, and how to make sure your employees aren’t stealing from you. One tip: if you think an employee is stealing, send the employee on vacation.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

PRICING

Car-dealer markups have been driving inflation: “Those extra dealer profits contributed between 0.3 and 0.7 percentage point of the nearly 16 percent rise in the consumer-price index between the end of 2019 and the end of 2022, a study published in a U.S. Bureau of Labor Statistics journal found. Auto demand surged after customers got pandemic stimulus checks, while supply-chain snarls reduced supply. The sales prices for new cars skyrocketed. Much of that additional money went into the pockets of dealers, according to the research. ‘It was really from famine to feast for dealers,’ said Michael Havlin, the economist who wrote the paper.”

‘The role of corporate profits in driving inflation is a heated subject. A recent study published by the Federal Reserve Bank of Kansas City argues that markups across industries accounted for more than half of inflation in 2021, with firms raising prices in anticipation of costs increasing later.”

“Mr. Havlin cross-checked the analysis against the financial disclosures of some of the large publicly traded auto dealerships. AutoNation marked up vehicles by almost 15 percent in the fourth quarter of 2021, versus less than 5 percent two years earlier, according to his calculations. Lithia Motors marked up cars by almost 16 percent in late 2021, up from about 6 percent two years earlier.”

“Inflation for financing, insurance, extended warranties, and other products also increased during this period. Such products aren’t constrained by supply, but Mr. Havlin concluded that the demand allowed dealerships to tease even more profit from that part of the business. ‘Those innovations didn’t go away,’ he said.” READ MORE

HUMAN RESOURCES

Research suggests remote work can increase productivity but there’s a price: “The economists — Natalia Emanuel, Emma Harrington and Amanda Pallais — studied engineers at a large technology company. They found that remote work enhanced the productivity of senior engineers, but it also reduced the amount of feedback that junior engineers received (in the form of comments on their code), and some of the junior engineers were more likely to quit the firm. The effects of remote work, in terms of declining feedback, were especially pronounced for female engineers. ‘We find a now-versus-later trade-off associated with remote work,’ said Ms. Harrington, an economist at the University of Iowa. ‘Particularly for junior engineers who are new to this particular firm, and younger engineers, they receive less feedback from their senior colleagues when they’re remote.’”

“The authors said their findings suggested something broader: that the office, at least for a certain type of white-collar knowledge worker, played an important role in early-career development. And the mentorship and training people get in person had so far proved hard to replicate on Slack and Zoom.”

“At least 10 times a day, Erika Becker, who works as a sales development manager at a technology company called Verkada, turns to her boss with questions. ‘Did I handle that correctly?’ she asks. ‘What could I have done better?’ Ms. Becker, 28, comes into her office in San Mateo, Calif., five days a week, along with all her colleagues.”

“The routine is a stark departure from her previous role at Yelp, where she worked from home and often spoke with her boss by phone just once in a day. Ms. Becker has rediscovered an upside of the office: feedback. Lots of it. ‘It’s like if there’s something in my teeth, I want you to tell me,’ she said. ‘Because I want to move up in my career.’” READ MORE

There’s a growing push to bring back child labor: “When Iowa lawmakers voted last week to roll back certain child labor protections, they blended into a growing movement driven largely by a conservative advocacy group. At 4:52 a.m., Tuesday, the state’s Senate approved a bill to allow children as young as 14 to work night shifts and 15-year-olds on assembly lines. The measure, which still must pass the Iowa House, is among several the Foundation for Government Accountability is maneuvering through state legislatures. The Florida-based think tank and its lobbying arm, the Opportunity Solutions Project, have found remarkable success among Republicans to relax regulations that prevent children from working long hours in dangerous conditions. And they are gaining traction at a time the Biden administration is scrambling to enforce existing labor protections for children.”

“The FGA achieved its biggest victory in March, playing a central role in designing a new Arkansas law to eliminate work permits and age verification for workers younger than 16.”

“That law passed so swiftly and was met with such public outcry that Arkansas officials quickly approved a second measure increasing penalties on violators of the child labor codes the state had just weakened.”

“In Missouri, where another child labor bill has gained significant GOP support, the FGA helped a lawmaker draft and revise the legislation, according to emails obtained by The Washington Post.” READ MORE

Paying down employee student debt is proving to be a popular benefit: “Companies big and small are adopting and expanding debt-repayment benefits for employees, many of whom will be required to restart loan payments later this year after a lengthy pandemic pause. The trend is a new twist on the old tuition assistance benefit, human-resources leaders said. Instead of offering to help fund a master’s or other advanced degree, many employers find that professionals in their 20s, 30s, and 40s need help paying down the debt they accumulated for their undergraduate studies. The benefit, which can be tax-exempt up to $5,250, is directed toward loan payment and is also proving to be an effective way to recruit and retain talent, HR leaders said.”

“Smaller firms are also launching these benefits to help with recruiting, said Kate Winget, a chief revenue officer at Morgan Stanley at Work, which offers education benefits to corporate clients through a program called Gradifi. About a quarter of Gradifi’s clients have fewer than 100 employees.”

“Student-loan repayment is now in ‘every single conversation we have’ with clients, Ms. Winget said, and the division has seen between 20 percent and 30 percent growth in new clients for Gradifi each year since 2018.” READ MORE

THE ECONOMY

In San Francisco, at least one downtown neighborhood has recovered: “The pandemic emptied storefronts across San Francisco, including the counterculture’s beating heart in the vintage- and thrift-store laden Haight-Ashbury, known internationally for its rainbow-covered aesthetic and quirky retail offerings. With numerous boarded-up shops and neighborhood fixtures signaling doomsday, the Haight in 2020 felt like a ghost town. The neighborhood has since bounced back with a new wave of boutiques and clothing stores, revitalizing the main commercial corridor at upper Haight Street.”

“Curated vintage and resale boutiques—posh thrift stores in layman’s terms—have cropped up all over the street, luring tourists and thrift-obsessed Gen Zers back. It’s a thriving micro-industry, one that’s largely driven by the enduring trendiness of thrift aesthetics and vintage fashion. But neighborhood and industry mainstays are concerned these boutiques are overpriced and may not last, following the breakneck trend cycles that have flung crop tops and flare-leg jeans in and right back out of fashion.”

“It started with Indigo Vintage Co-Op, a curated upscale clothing store that stocks ‘90s and Y2K fashion. Like a more expensive Buffalo Exchange, the store did what the lazy thrifter always dreams of: It curated trendy items directly for the consumer, doing all the heavy lifting to find, source, and sell hip, vintage, and upcycled garments. Removing the rack-sifting element puts some thrifters off, but delights others.”

“Then it was like dominoes as Haight Street became the epicenter for Gen Z’s new curated thrift aesthetic. ‘All of a sudden, all these other shops that were sort of going after Indigo’s business model showed up,’ Taylor said. ‘Now there’s like 15 new Indigos. They’re all just feeding each other, and prices are going insane.’”

“Popular resale sites like Depop and Thredup largely prop up this online industry. But the cultural effect they’ve had on the fashion world bled into Haight Street, creating a brick-and-mortar manifestation of the resale craze.” READ MORE

The Hustle takes a graphic look at which cities’ commercial cores are doing best:

THE 21 HATS PODCAST

‘It’s Going to Take $8 Million in Financing:’ This week, Stephanie Stuckey tells Paul Downs and Liz Picarazzi how she and her partners have taken their business from $2 million in annual revenue to more than $13 million in three years. What’s frustrating, she says, is that she could be selling a lot more pecan snacks and candies. But with production at capacity, she’s not doing much sales outreach until they can fully revamp their manufacturing operation, which will require a significant investment. “I spend my days doing financial paperwork,” Stephanie says. Plus: Liz explains why her business picks up when the weather warms up, and after a slow start, Paul gets a boost from a big manufacturer.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

Thanks for reading, everyone. — Loren