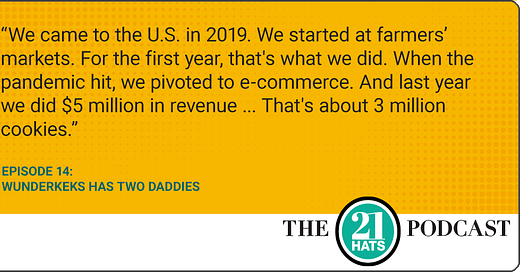

Wunderkeks Has Two Daddies

In our latest podcast episode, Hans Schrei explains how he and husband Luis Gramajo immigrated from Guatemala in 2019, built a $5 million ecommerce business, and chose a marketing strategy.

Good morning!

Here are today’s highlights:

There are some things you can do to offset rising interest rates.

More businesses, with a variety of products, are using “drops” to create a sense of scarcity.

In Chicago, a website helps prospective renters place bids on rentals—often for more than the asking price.

The average price paid for an electric vehicle is up 22 percent over last year.

THE 21 HATS PODCAST

This week, we welcome another new panelist to the podcast, Hans Schrei, who is co-founder of Wunderkeks, an e-commerce bakery in Austin, Texas. Hans tells Jay Goltz and Liz Picarazzi why he and Luis Gramajo, his husband and co-founder, sold a business in Guatemala, immigrated here in 2019, and started a cookie business from scratch, going from selling at farmers’ markets their first year to doing more than $5 million in e-commerce last year. Hans also explains why he doesn’t think it’s enough just to make a delicious cookie, why he’s trying to raise seed capital, and what would happen to his visa if Wunderkeks were to fail.”

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

FINANCE

Gene Marks offers suggestions on managing finances with interest rates rising: “For starters, small business owners should be making sure that we’re paying down our credit card debt and any other higher interest loans with variable rates. The interest on this debt could become very costly. If you’re able to pay down these higher rate loans, then do it. If not, then try and convert this debt — or portions of it — to longer-term loans with fixed interest rates, even if it means pledging collateral to secure these loans. ‘Rising debt service costs can be a material, and unexpected, hit to cash flow and preparing for that early is crucial,’ says Clifford P. Haugen, a financial advisor with BLB&B Advisors, in Montgomeryville, [Pa.]. ‘If a small business owner hasn’t looked at the terms of his or her loans recently, now is a good time to do that.’” Meanwhile:

“Consider putting any cash you don’t need for six months or a year into FDIC-insured certificates of deposit, which generally pay higher interest but lock up your funds for a period of time.”

“While we’re on the topic of cash, we should all be doing our best to manage it better. That means stepping up our credit and collection activities to ensure that any open receivables we have aren’t outstanding more than 30 days or even less if possible. The longer our invoices stay open, the less interest we’re receiving on our money.” READ MORE

RETAIL

If limited-edition “drops” work for sneakers, would they work for other products? “For smaller businesses, selling a set amount of inventory at specific times means less overhead. Before the pandemic, Miriam Weiskind, who lives in Brooklyn, quit her job as an art director to pursue her passion of making pizza. Her dream, like many chefs, is to open a restaurant, but the economics of that are daunting. So in the meantime, she started The Za Report. Using a drop model, she sells her pies twice a week at breweries and street fairs. She announces where she will be on Instagram a few days in advance, and lines are usually waiting for her when she opens. She sells 70 to 120 pies at a time, and some days they sell out within an hour.”

“She likes that her overhead is low and believes this sales model allows her to sell her pies at higher prices (they range from $18 to $24). ‘It keeps the demand high and the supply low,’ she said. ‘Each pie is special because I don’t make that many of them, so I can charge a lot more.’”

“A range of companies, big and small and in a variety of categories, are utilizing ‘the drop,’ releasing limited-edition items in small numbers at a particular time. Some businesses that opened during the pandemic have only sold products this way.”

“More established companies are turning from more traditional sales models, like releasing a collection every season or having a store that consistently has merchandise, and adopting this strategy.” READ MORE

Amazon’s Prime Day doesn’t seem to have the impact it once did: “Sales growth for the online shopping extravaganza has slowed and consumers aren’t purchasing orders as large as they once did, data show. Amazon doesn’t appear to be investing in the event as it has in the past, and many of the deals have been focused on the company’s own products. Excluding electronics, the discounts on many items don’t surpass those on other days at Amazon, data show. The online commerce giant plans to hold Prime Day this year on July 12 and 13, continuing a recent trend of holding the event longer than a day to maximize its revenue.”

“Amazon’s sales are projected to reach roughly $7.76 billion in the U.S. from Prime Day, or about 17 percent more than during last year’s event, according to research firm Insider Intelligence.”

“While the event will still give Amazon a much-needed boost in the third quarter, Prime Day sales growth in recent years has slowed. Revenue was once growing at a roughly 65 percent clip, Insider Intelligence reports.” READ MORE

HUMAN RESOURCES

Despite the labor shortage, businesses are still overlooking groups of available workers: “As of May, there were about six million people looking for work in the U.S. Another 5.7 million people have given up the search but still want a job. However, businesses still say they're struggling to recruit and retain workers amid the ongoing labor shortage. One reason could be that some of these businesses are leaving out certain groups of job candidates. Formerly incarcerated, retired people looking to get back to work, and people with disabilities could be the answer to businesses' hiring woes, Daniel Zhao, senior economist and data scientist at Glassdoor, previously told Insider. It could be a talent pool of more than 117 million potential workers.”

“In a hot labor market, these groups of workers ‘tend to see more job opportunities,’ Zhao said. And in a time when remote work has become more common, people who require accommodations or may feel uncomfortable in an office setting are even more able to find work from companies nationwide.”

“And yet experts say businesses consistently overlook talent pools they aren't familiar with — even though they could be the answer to their staffing crisis.” READ MORE

THE ECONOMY

Now there are bidding wars for rentals: “Real-estate agents from New York to Chicago and Atlanta say they see more people than ever making offers above asking to lease homes and apartments that they will never own. An increasing number of white-collar professionals—some of whom recently sold homes—are reluctant to buy because of record-high home prices, rising mortgage rates and limited supply. They are renting instead, helping to drive a frenzy for leased properties of all kinds, and helping fuel the trend of offering above asking rents, real-estate agents said.”

“The median U.S. asking rent passed $2,000 for the first time in May, according to real-estate company Redfin, and it has risen 15 percent over the past 12 months.”

“Many renters don’t stop at offering a higher rental price. Some are following other parts of the home-buyer playbook, such as drafting ‘pick me’ love letters that introduce themselves to a landlord and make an emotional appeal.”

“In Chicago, the website Brixbid.com facilitates an influx of people bidding on rent. Landlords start the bidding with a suggested price. Renters then have the choice to lowball them or bid even higher.”

“Some apartments now go 10 percent to 15 percent over ask on Brixbid, said company co-founder James Peterson.” READ MORE

On average, Americans are paying $54,000 for an electric vehicle: “Automakers have been raising prices on electric cars, partly to offset the soaring cost of materials used in their large batteries. Car executives also are capitalizing on strong consumer interest in EVs, as a new wave of plug-in vehicles hits the market. In the past few months, Tesla, Ford, General Motors, Rivian, and Lucid have increased prices on certain electric models. Last week, GM tacked on $6,250 to the price of GMC Hummer electric pickup-truck models, which now range from around $85,000 to $105,000, citing an increase in commodity and logistics costs. The waiting list for the recently released truck is about two years, a GM spokesman said.”

“Overall, the average price paid for an electric vehicle in the U.S. in May was up 22 percent from a year earlier, at about $54,000, according to J.D. Power.”

“By comparison, the average paid for an internal-combustion vehicle increased 14 percent in that period, to about $44,400.” READ MORE

SOCIAL MEDIA

If you’re trying to reach Gen Z, there’s a new social media app to figure out: “BeReal, which has been called ‘Gen Z’s new favorite social media app,’ launched in January 2020 as a response to the polished, hyper-curated feeds on Instagram and TikTok. In the past year alone, BeReal has amassed more than 7.5 million users, which accounts for 75 percent of the app’s total downloads. ... The app is simple to use. Once a day at a random time, BeReal sends you a push notification to post a photo. The BeReal photo – both a selfie and a frontal photo with no filter or edit options – must be taken within two minutes or else the post is tagged as ‘late.’ In order to scroll on the BeReal feed, you must post once and only once each day.”

“In May, a Chipotle employee snapped a BeReal with a fork and a reusable promo code for a free entree available to the first hundred users. Within 30 minutes, all promo codes had been claimed.”

“After the success of its first BeReal campaign, Chipotle now has more than 2,000 ‘friends’ — the term for followers in BeReal — and appears to be carving out a BeReal social media strategy.” READ MORE

FOOD & BEVERAGE

A couple of former Goldman Sachs bankers are now in the chocolate business: “[Kushal] Choksi and his wife Alak Vasa, a former vice president for algorithmic trading at Goldman, are the founders of Elements Truffles. The Jersey City-based chocolate company specializes in sweets inspired by ayurveda, the Indian practice of natural medicine that highlights ingredients such as turmeric that are believed to have healing and health benefits. They sell a line of gorgeously packaged bars—labels are block printed with vegetable ink and stitched onto boxes— made without refined sugar or soy. Instead, such selections as Sea Salt with Turmeric and Orange Quinoa are sweetened with local honey and made with ethically sourced cacao from Ecuador.”

“Their chocolate, which goes for around $7 for a 2-oz. bar, has a pure, deep tropical fruit flavor that slowly melts into your mouth.”

“They launched the company with $100,000 of their money and have taken no outside investment.”

“Elements products are currently in 2,000 stores, including four regions of Whole Foods Market.”

“Choksi says Elements has been profitable since the second year of business, with an average net profit margin currently at 20 percent.” READ MORE

THE 21 HATS PODCAST

Dashboard: Keep Calm and Carry a Lot of Inventory! Gene Marks, our man in London (at least for this week), reports that small businesses in the UK are doing quite well, thank you! Marks and also discusses how your CRM system can help you fight inflation, the good news about bankruptcy laws, how to increase profits without raising prices, and whether it’s now okay to swear in the office. Cheers!

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

If you see a story that business owners should know about, hit reply and send me the link. If you got something out of this email, you can click the heart symbol, you can click the comment icon below, and you can share it with a friend. Thanks for reading, everyone. — Loren