‘You See Nutty Things’

The pandemic has turned the car market—and lots of other things—upside down.

Good morning!

Here are today’s highlights:

Gene Marks makes the case for the labor shortage easing—and for not using paper checks.

That Canadian trucker protest is taking a toll on auto-industry suppliers.

Stacy Spikes is taking another crack at MoviePass.

Have you asked yourself the “Uncle Joe question”?

HUMAN RESOURCES

Gene Marks thinks businesses will have an easier time hiring this year: “Businesses are struggling to find good workers. This, in addition to inflation concerns, is what drove small business optimism levels to an 11-month low, according to this week's survey from the National Federation of Independent Businesses. Will the worker shortage end? Not anytime soon. But the supply of labor will be increasing significantly in 2022.” Why?

Higher pay: “Returning workers – particularly younger workers who do entry-level jobs – are finding higher levels of compensation. ‘The inflation, that’s starting to drive people back into the workforce,’ Paychex CEO Martin Mucci told CNBC last week. ‘It's tough to turn those wages back, so wage inflation is here to stay.’”

Lower Covid concern: “Workers are becoming less concerned about closings and lockdowns disrupting their personal lives and are increasingly more comfortable returning to their jobs, and to normal life.”

More flexibility: “Small business owners like me are waking up to a new workplace reality. People want flexibility. They want to work from home, at least some of the time. They need expanded benefits for mental health. They want to feel safe at work, both from Covid and from discrimination, harassment, and a toxic environment.” READ MORE

BANKING

Gene Marks also says he knows how to steal money from your company’s bank account—because it happened to a client: “More than 80 percent of businesses still use paper checks and although [my client is] doing her best to make more online payments, [she] is one of them. Someone (she doesn’t know who) received a paper check from her business that was written anytime during the past 20 years. That paper check — like all paper checks — had the bank’s routing number and my client’s bank account number printed on it. Go ahead and look at your checks. Those numbers are at the bottom. The criminal set up a fake company with a bank account at another bank and configured it to accept ACH payments. He (or she) then simply made an ACH request to my client’s bank using the routing and account numbers from her check. Boom. Money transferred.”

“You don’t believe that? Well, try it yourself. Ask for a friend’s check. Then go to a site that will allow you to pay via ACH transfer. The IRS allows this for estimated tax payments. So do many states. So do many other private corporations and educational institutions.”

“Ask for a $1 payment to be made from your friend’s checking account and use the routing and account numbers from the check. Go ahead. See what happens. You now owe that friend a dollar.”

“The takeaway? First of all, make it a point to stop using paper checks. Also, call your bank right now and find out if it’s possible for any stranger who has a copy of any past checks to initiate an ACH transfer just by using your routing and account numbers found on the check.”

“Then find out what additional service the bank provides to control this.” READ MORE

THE COVID ECONOMY

The Canadian trucker protest is snarling the auto industry and taking an economic toll: “With Canadian officials baffled about what to do, the main routes that handle the steel, aluminum and other parts that keep car factories running on both sides of the border were essentially shut down Wednesday and Thursday. Ford Motor, General Motors, Honda and Toyota have curtailed production at several factories in Michigan and Ontario, threatening paychecks and offering a fresh reminder of the fragility of global supply chains and of the deep interdependence of the U.S. and Canadian economies, which exchange $140 million in vehicles and parts every day.”

“The pain is likely to be most acute for smaller auto parts suppliers, for independent truckers and for workers who get paid based on their production.”

“Many of these groups, unlike large automakers like G.M., Ford, and Toyota, lack the clout to raise prices of their goods and services.”

“No one knows how this is going to end. The protests are expected to swell in the coming days and could spread, including to the United States.” READ MORE

Some used cars are worth more now than when they were new: “The prolonged inventory crunch of dealership lots is turning the U.S. used-car market upside down: Once-depreciating vehicles are rising in value, and some recently purchased ones are worth more now than their original price. With car companies still trying to resume normal levels of factory output, dealers have been left with a scarcity of new vehicles to sell at stores, pushing many buyers into the used-car market where they are also encountering limited options.”

“Used-car prices rose 40.5 percent in January from a year ago, according to data released Thursday by the Labor Department, a jump that helped accelerate U.S. inflation to an annual rate of 7.5 percent last month, a new four-decade high.”

“‘You see nutty things. Cars that were $25,000 new three years ago are $25,000 today,’ said Adam Lee, chairman of Lee Auto Malls in Maine. ‘It doesn’t make any sense.’” READ MORE

A survey finds small-business sentiment at an 11-month low: “The National Federation of Independent Business said its Small Business Optimism Index dropped 1.8 points to 97.1 last month, the lowest reading since February 2021. Scarce workers and rising labor costs remain the main areas of worry for businesses.”

“About 27 percent of small businesses said they planned to increase compensation in the next three months, down 5 points from December, but still historically high.”

“Eleven percent said labor costs were their top business problem, down 2 points from December's 48-year record high reading.”

“Faced with rising labor costs, the share of small businesses raising average selling prices jumped 4 points to 61 percent, the highest reading since the fourth quarter of 1974.” READ MORE

STARTUPS

Two years after MoviePass crashed and burned, co-founder Stacy Spikes announced it will return this summer:

Gone is the $10-a-month, all-you-can watch subscription pass that bankrupted the business: “Under the new model, MoviePass will run on tradable credits that roll over month to month. Subscribers will also be able to use their credits to bring a friend, a markedly different approach from the single-user card system that MoviePass used previously, which could prove annoying for non-cardholders. MoviePass 2.0 will also work on a tiered system, Spikes said. Spikes shared images of a beta version of the new app and the credit-based system, which will vary based on things like peak moviegoing hours. MoviePass’ ambitions for subscribers are, charitably, ambitious. Spikes wants to claim 30 percent of the moviegoer market by 2030, MoviePass’ ‘moonshot’ goal.” READ MORE

FINANCE

Ami Kassar wants you to ask the “Uncle Joe question”: “If Uncle Joe presented you with a check for $1 million and said that you had to invest in your business in 2022 (in things you are not doing today) or give it back at the end of the year, what would you do with the money? Once you have the list, ask yourself why you aren't doing these things anyway? Money is either sitting in your bank account or cheap to get.” READ AMI’S BLOG

MARKETING

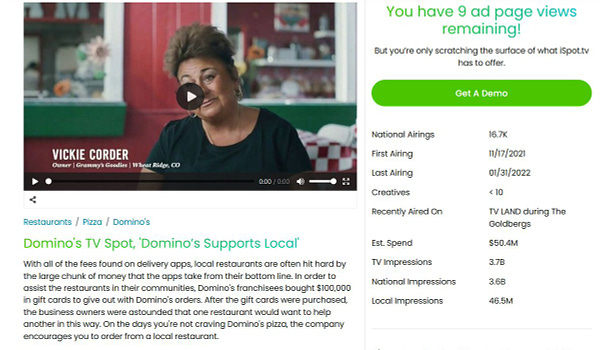

Everyone loves to say how much they support small businesses, but how much support do they actually provide:

THE 21 HATS PODCAST

Have You Considered Not Taking Investors? This week, Jay Goltz, Liz Picarazzi, and Dana White talk about the advantages and disadvantages of bringing in outside capital and expertise—something both Liz and Dana have considered. “I have a background in Russian literature and credit card marketing,” says Liz. “I'm now a manufacturer, so if I could have an outside investor who either brought that to the table or could help me with it, that would be really valuable.” But of course, there are trade-offs. We also talk about Dana’s looming franchise sales, why it’s so hard to hire lawyers and accountants, and whether there’s an opportunity for Jay in framing NFT art.

You can subscribe to the 21 Hats Podcast wherever you get podcasts.

If you see a story that business owners should know about, hit reply and send me the link. If you got something out of this email, you can click the heart symbol, you can click the comment icon below, and you can share it with a friend. Thanks for reading, everyone. — Loren